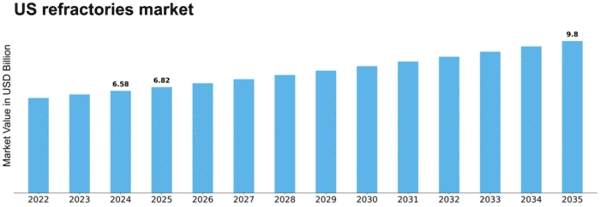

Us Refractories Size

US Refractories Market Growth Projections and Opportunities

The US Refractories Market is influenced by a range of market factors that collectively shape its growth and dynamics. A primary driver is the demand from industries that rely on high-temperature processes, such as steel, cement, glass, and non-ferrous metals. Refractories, which are heat-resistant materials, play a critical role in these industries by providing linings for furnaces, kilns, and reactors. As these sectors experience fluctuations in production and construction activities, the demand for refractories in the United States varies, contributing to the cyclical nature of the refractories market.

Moreover, the steel industry's performance significantly impacts the US Refractories Market. The steel sector is one of the largest consumers of refractories, using them in various applications such as blast furnaces, converters, and ladles. The demand for refractories in steel manufacturing is closely linked to steel production levels, which, in turn, are influenced by factors such as infrastructure development, manufacturing activities, and global demand for steel. Changes in steel industry dynamics, including capacity expansions or contractions, have a direct impact on the refractories market in the United States.

Technological advancements and innovations in refractories contribute to market dynamics. Continuous research and development efforts focus on improving the performance, durability, and cost-effectiveness of refractory materials. Innovations include the development of advanced refractory ceramics, monolithic refractories, and insulating materials, catering to the evolving needs of industries seeking longer service life, enhanced energy efficiency, and reduced downtime for maintenance. Technological advancements drive the adaptation of new and improved refractories in various applications across different sectors.

Global economic conditions and trade dynamics also influence the US Refractories Market. Refractory materials are globally traded commodities, and factors such as international trade agreements, tariffs, and geopolitical events can impact the supply chain and market conditions. Economic stability, particularly in sectors with high refractory demand, and trade policies play a role in determining the accessibility and cost competitiveness of refractory materials in the US market.

Environmental considerations and regulatory standards shape the refractories market. As industries face increasing pressure to reduce emissions and adopt cleaner technologies, refractory manufacturers are compelled to develop products that align with environmental regulations. Environmental standards related to air quality and emissions from high-temperature processes impact the selection and use of refractories in industrial applications. Compliance with these standards is essential for refractory manufacturers operating in the US market.

Market competition and industry consolidation are notable factors shaping the US Refractories Market. The market features both large multinational refractory producers and regional players, leading to competitive pricing strategies, technological innovations, and market expansions. Mergers, acquisitions, and collaborations occur as companies aim to enhance their product portfolios, gain a competitive edge, and strengthen their positions in the refractories market. The competitive landscape encourages advancements in refractory technologies and solutions.

Challenges related to raw material availability, price volatility, and the need for skilled labor are factors that the refractories industry addresses. The production of refractories requires specialized raw materials, and fluctuations in the prices of key inputs, such as minerals and metals, can impact overall production costs. The refractories industry also faces challenges related to the availability of skilled labor, particularly in the installation and maintenance of refractory linings, which are critical for the performance and longevity of refractories in high-temperature applications.

Leave a Comment