Us Paints Coatings Size

US Paints Coatings Market Growth Projections and Opportunities

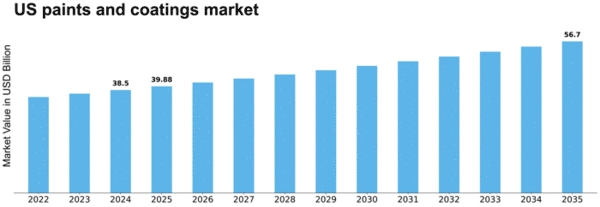

US Paints and Coatings Market Size was valued at USD 25.8 Billion in 2022. The paints and coatings industry is projected to grow from USD 26.96 Billion in 2023 to USD 38.341 Billion by 2032, exhibiting a compound annual growth rate (CAGR) of 4.50%

The US Paints and Coatings Market is influenced by a diverse array of market factors that collectively contribute to its growth and evolution. One of the primary drivers is the construction and real estate industry's activities. The demand for paints and coatings is intricately tied to construction projects, both in the residential and commercial sectors. As new buildings are constructed and existing structures undergo renovations, there is a consistent need for a variety of paints and coatings to protect surfaces, enhance aesthetics, and meet regulatory requirements. The cyclical nature of construction and maintenance activities plays a pivotal role in shaping the demand dynamics of the US Paints and Coatings Market.

Moreover, technological advancements in paint formulations contribute significantly to market dynamics. Continuous research and development efforts focus on creating innovative paints and coatings that offer improved performance, durability, and environmental sustainability. The development of low-VOC (volatile organic compound) and eco-friendly formulations addresses growing concerns about environmental impact and health hazards associated with traditional paint products. Technological innovations drive product differentiation and cater to the increasing demand for sustainable and high-performance coatings in the US market.

The automotive industry's requirements for specialized coatings influence the paints and coatings market. Automotive coatings play a critical role in protecting vehicles from corrosion, enhancing visual appeal, and meeting performance standards. As the automotive industry continues to innovate in terms of design and materials, the demand for advanced coatings with features such as self-healing, anti-scratch, and anti-reflective properties contributes to the evolution of the US Paints and Coatings Market.

Government regulations and environmental standards impact the paints and coatings industry. Regulatory frameworks set by environmental agencies dictate the permissible levels of VOCs and other harmful substances in paint formulations. Compliance with these regulations is essential for paint manufacturers to ensure that their products meet environmental standards and contribute to sustainable practices in the US market.

Market competition and industry consolidation are notable factors shaping the US Paints and Coatings Market. The market comprises a mix of multinational corporations and regional players, leading to competitive pricing strategies, product innovations, and market expansions. Mergers, acquisitions, and collaborations are common as companies seek to enhance their product portfolios, gain a competitive edge, and strengthen their presence in the market. The competitive landscape fosters innovation and the introduction of diverse coatings options for consumers in the United States.

Global economic conditions and trade dynamics impact the paints and coatings market. As a globally traded commodity, factors such as international trade agreements, tariffs, and geopolitical events can influence the supply chain and market conditions for paints and coatings in the US. Economic stability and trade policies play a role in determining the accessibility and cost competitiveness of raw materials and finished products.

The influence of architectural trends and consumer preferences also shapes the paints and coatings market. Changing design preferences, color trends, and the demand for specialty finishes contribute to the variety of products available in the market. Paint manufacturers often align their product offerings with prevailing design aesthetics and consumer preferences, reflecting the dynamic nature of the US Paints and Coatings Market.

Challenges related to raw material availability, price volatility, and fluctuating demand due to economic uncertainties are factors that the industry navigates. The prices of key raw materials, such as pigments, resins, and solvents, can be subject to fluctuations based on market conditions and global supply chain dynamics. Economic uncertainties may impact construction and consumer spending, influencing the overall demand for paints and coatings in the US market.

Leave a Comment