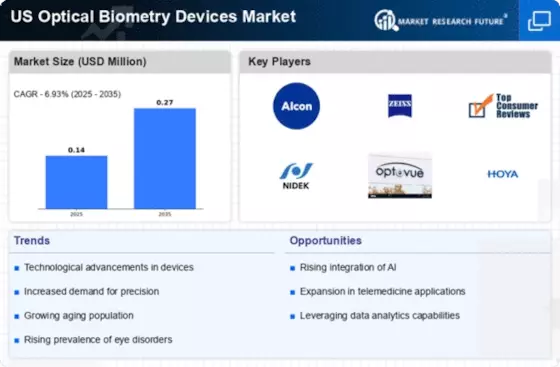

The Optical Biometry Devices Market is characterized by a dynamic competitive landscape, driven by technological advancements and increasing demand for precise ocular measurements. Key players such as Alcon (US), Carl Zeiss (US), and Bausch + Lomb (US) are at the forefront, each adopting distinct strategies to enhance their market presence. Alcon (US) focuses on innovation, particularly in developing next-generation biometry devices that integrate advanced imaging technologies. Meanwhile, Carl Zeiss (US) emphasizes partnerships with healthcare providers to expand its reach and improve service delivery. Bausch + Lomb (US) is actively pursuing mergers and acquisitions to bolster its product portfolio, thereby enhancing its competitive edge in the market.

The business tactics employed by these companies include localizing manufacturing and optimizing supply chains to reduce costs and improve efficiency. The market structure appears moderately fragmented, with several players vying for market share. However, the collective influence of major companies like Alcon (US) and Carl Zeiss (US) suggests a trend towards consolidation, as these firms leverage their resources to dominate the market.

In December 2025, Alcon (US) announced the launch of its latest optical biometry device, which incorporates artificial intelligence to enhance measurement accuracy. This strategic move is likely to position Alcon (US) as a leader in innovation, appealing to healthcare providers seeking cutting-edge solutions. The integration of AI not only improves the precision of ocular measurements but also streamlines the workflow in clinical settings, potentially increasing adoption rates among practitioners.

In November 2025, Bausch + Lomb (US) completed the acquisition of a smaller biometry technology firm, which is expected to expand its capabilities in the optical biometry space. This acquisition underscores Bausch + Lomb's commitment to enhancing its technological offerings and reflects a broader trend of consolidation within the industry. By integrating new technologies, the company aims to provide comprehensive solutions that meet the evolving needs of eye care professionals.

In October 2025, Carl Zeiss (US) entered into a strategic partnership with a leading telemedicine provider to enhance remote patient monitoring capabilities. This collaboration is indicative of the growing trend towards digital health solutions, allowing for more accessible and efficient patient care. By leveraging telemedicine, Carl Zeiss (US) is likely to expand its market reach and improve patient outcomes, aligning with the increasing demand for integrated healthcare solutions.

As of January 2026, the competitive trends in the Optical Biometry Devices Market are increasingly defined by digitalization, sustainability, and the integration of AI technologies. Strategic alliances are becoming pivotal in shaping the landscape, as companies seek to enhance their technological capabilities and market reach. The shift from price-based competition to a focus on innovation and supply chain reliability is evident, suggesting that future competitive differentiation will hinge on the ability to deliver advanced, reliable, and sustainable solutions.