Market Growth Projections

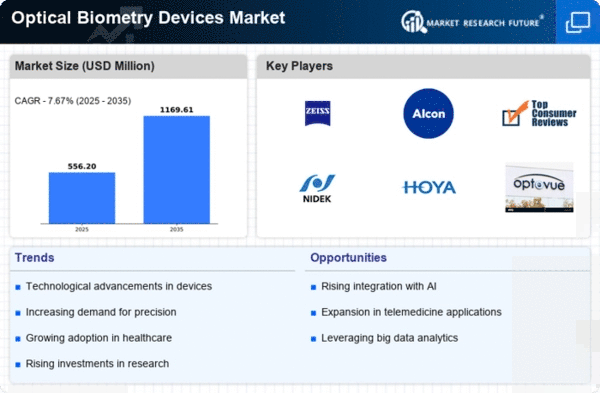

The Global Optical Biometry Devices Market Industry is projected to experience substantial growth over the next decade. With an anticipated compound annual growth rate (CAGR) of 11.83% from 2025 to 2035, the market is set to expand significantly. The growth trajectory is supported by increasing technological innovations, a rising geriatric population, and heightened awareness of eye health. This upward trend indicates a promising future for optical biometry devices, as they become integral to modern ophthalmic practices.

Technological Advancements

The Global Optical Biometry Devices Market Industry is experiencing rapid technological advancements, which enhance the accuracy and efficiency of ocular measurements. Innovations such as swept-source optical coherence tomography and improved algorithms for data analysis are being integrated into biometry devices. These advancements not only improve patient outcomes but also streamline the workflow in clinical settings. As a result, the market is projected to grow from 0.13 USD Billion in 2024 to 0.46 USD Billion by 2035, indicating a robust demand for cutting-edge optical biometry solutions.

Rising Geriatric Population

The aging population worldwide is contributing to the expansion of the Global Optical Biometry Devices Market Industry. As individuals age, they are more susceptible to various ocular conditions, including cataracts and age-related macular degeneration. According to demographic studies, the proportion of individuals aged 65 and older is expected to increase significantly in the coming years. This demographic shift is likely to drive demand for optical biometry devices, as healthcare systems adapt to the needs of an older population requiring specialized eye care.

Growing Awareness and Accessibility

There is a noticeable increase in awareness regarding eye health and the importance of regular eye examinations, which is positively impacting the Global Optical Biometry Devices Market Industry. Educational campaigns and initiatives by health organizations are promoting the significance of early detection and treatment of eye conditions. Furthermore, advancements in telemedicine and mobile health technologies are enhancing accessibility to eye care services, particularly in underserved regions. This trend is expected to drive the adoption of optical biometry devices, as more patients seek timely and effective eye care solutions.

Increasing Prevalence of Eye Disorders

The rising incidence of eye disorders globally is a significant driver for the Global Optical Biometry Devices Market Industry. Conditions such as cataracts and refractive errors are becoming more prevalent, necessitating precise measurement tools for effective diagnosis and treatment. The World Health Organization reports that millions of people are affected by vision impairment, which underscores the need for advanced biometry devices. This growing patient population is likely to propel market growth, as healthcare providers seek reliable solutions to address these challenges.

Investment in Healthcare Infrastructure

Investment in healthcare infrastructure, particularly in developing countries, is a crucial driver for the Global Optical Biometry Devices Market Industry. Governments and private entities are increasingly allocating resources to enhance healthcare facilities and improve access to advanced medical technologies. This investment is likely to facilitate the integration of optical biometry devices into clinical practice, thereby improving diagnostic capabilities. As healthcare systems evolve, the demand for sophisticated biometry solutions is expected to rise, contributing to the overall growth of the market.