Regulatory Compliance and Safety Standards

The US Automotive Occupant Sensing System Market is significantly influenced by stringent regulatory compliance and safety standards set forth by government agencies. The National Highway Traffic Safety Administration (NHTSA) has established regulations that mandate the inclusion of advanced occupant sensing systems in new vehicles to enhance passenger safety. These regulations are designed to minimize the risk of injury during accidents, particularly for children and smaller adults. As a result, automotive manufacturers are compelled to invest in advanced occupant sensing technologies to meet these requirements. The market is expected to see a steady increase in demand as compliance with these regulations becomes a priority for manufacturers, thereby driving growth in the US Automotive Occupant Sensing System Market.

Consumer Demand for Enhanced Safety Features

The US Automotive Occupant Sensing System Market is witnessing a notable increase in consumer demand for enhanced safety features in vehicles. As awareness of vehicle safety continues to rise, consumers are increasingly seeking vehicles equipped with advanced occupant sensing systems that provide better protection for all passengers. This trend is reflected in market data indicating that nearly 70% of consumers prioritize safety features when purchasing a vehicle. Consequently, automotive manufacturers are responding by integrating sophisticated occupant sensing technologies into their models. This shift not only caters to consumer preferences but also aligns with the industry's broader goal of reducing accident-related injuries and fatalities, thus propelling the growth of the US Automotive Occupant Sensing System Market.

Rising Awareness of Child Safety in Vehicles

Rising awareness of child safety in vehicles is a crucial driver for the US Automotive Occupant Sensing System Market. Parents and guardians are increasingly concerned about the safety of child passengers, leading to a heightened demand for vehicles equipped with advanced occupant sensing systems that can accurately detect the presence of children. This trend is supported by data indicating that a significant percentage of parents prioritize child safety features when selecting a vehicle. As a result, automotive manufacturers are focusing on developing and implementing advanced sensing technologies that cater specifically to the needs of child passengers. This growing emphasis on child safety is expected to drive innovation and investment in the US Automotive Occupant Sensing System Market, ultimately enhancing the overall safety of vehicles.

Technological Advancements in Sensing Systems

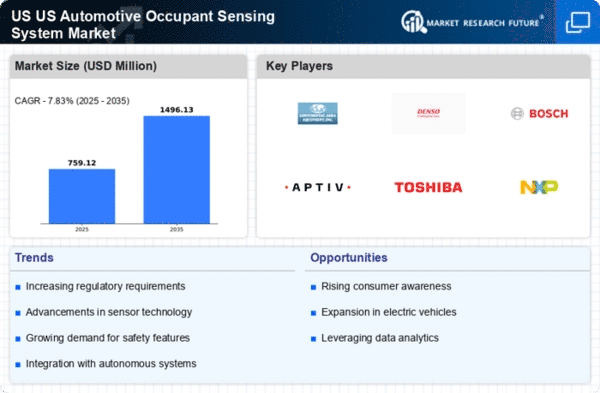

The US Automotive Occupant Sensing System Market is experiencing a surge in technological advancements that enhance the functionality and reliability of occupant sensing systems. Innovations such as improved sensor technologies, including pressure sensors and infrared sensors, are being integrated into vehicles to provide more accurate detection of occupants. These advancements not only improve safety but also contribute to the overall efficiency of airbag deployment systems. According to recent data, the market for advanced sensing technologies is projected to grow at a compound annual growth rate (CAGR) of approximately 8% over the next five years. This growth is driven by the increasing demand for smart vehicles equipped with sophisticated safety features, thereby propelling the US Automotive Occupant Sensing System Market forward.

Integration of Advanced Driver Assistance Systems (ADAS)

The integration of Advanced Driver Assistance Systems (ADAS) is a pivotal driver for the US Automotive Occupant Sensing System Market. As vehicles become increasingly equipped with ADAS technologies, the need for reliable occupant sensing systems becomes paramount. These systems work in conjunction with ADAS to enhance overall vehicle safety by ensuring that airbag deployment is optimized based on the presence and position of occupants. The market for ADAS is projected to grow significantly, with estimates suggesting a CAGR of around 10% over the next five years. This growth is likely to stimulate demand for advanced occupant sensing systems, as manufacturers strive to create vehicles that not only meet safety standards but also provide a seamless integration of safety technologies, thereby benefiting the US Automotive Occupant Sensing System Market.