Government Support and Funding

Government initiatives play a pivotal role in the agriculture analytics market. Various federal and state programs are designed to support farmers in adopting advanced analytics tools. For instance, the USDA has allocated substantial funding to promote precision agriculture technologies, which are integral to the analytics market. In 2025, it is estimated that government funding for agricultural technology will reach approximately $1 billion, reflecting a growing recognition of the need for data-driven farming solutions. This financial support not only encourages the adoption of analytics tools but also fosters innovation within the industry. As a result, the agriculture analytics market is likely to benefit from increased investment and resources, facilitating growth and development.

Rising Demand for Food Security

The rising demand for food security is a significant influence on the agriculture analytics market. As the global population continues to grow, the pressure on agricultural systems intensifies. In the US, food production must increase by 70% by 2050 to meet the needs of the population. This urgency drives the adoption of analytics tools that enhance crop yields and resource management. Farmers are increasingly turning to data analytics to optimize their operations, reduce waste, and improve sustainability. The agriculture analytics market is expected to expand as stakeholders recognize the importance of data-driven strategies in addressing food security challenges. This trend indicates a shift towards more efficient agricultural practices, which are essential for meeting future food demands.

Increased Focus on Sustainability

Sustainability has become a central theme in the agriculture analytics market. As consumers demand more environmentally friendly practices, farmers are seeking ways to reduce their ecological footprint. Analytics tools provide insights into resource usage, enabling farmers to implement sustainable practices such as precision irrigation and crop rotation. In 2025, it is projected that the market for sustainable agriculture analytics will grow by 15%, reflecting a shift towards eco-conscious farming. This focus on sustainability not only meets consumer expectations but also aligns with regulatory requirements aimed at reducing environmental impact. Consequently, the agriculture analytics market is likely to thrive as it supports farmers in adopting practices that promote sustainability and compliance.

Technological Advancements in Agriculture

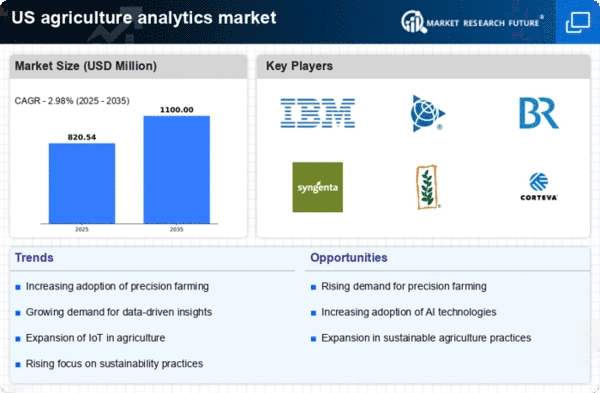

The agriculture analytics market is experiencing a surge due to rapid technological advancements. Innovations in data collection methods, such as drones and satellite imagery, enable farmers to gather real-time data on crop health and soil conditions. This data is crucial for making informed decisions, thereby enhancing productivity. The market is projected to grow at a CAGR of 12.5% from 2025 to 2030, driven by these technological improvements. Furthermore, the integration of machine learning algorithms allows for predictive analytics, which can forecast yields and optimize resource allocation. As farmers increasingly adopt these technologies, the agriculture analytics market is likely to expand significantly, providing tools that enhance efficiency and sustainability in farming practices.

Growing Interest in Data-Driven Decision Making

The agriculture analytics market is witnessing a growing interest in data-driven decision making among farmers and agribusinesses. As the availability of data increases, stakeholders are recognizing the value of analytics in enhancing operational efficiency. The ability to analyze large datasets allows for better forecasting, risk management, and strategic planning. In 2025, it is estimated that 60% of farmers will utilize some form of data analytics in their operations, reflecting a significant shift towards informed decision making. This trend is likely to drive the agriculture analytics market as more stakeholders seek to leverage data for competitive advantage. The emphasis on data-driven strategies suggests a transformation in how agricultural practices are approached, leading to improved outcomes and profitability.