Market Trends

Key Emerging Trends in the Underfill Dispensers Market

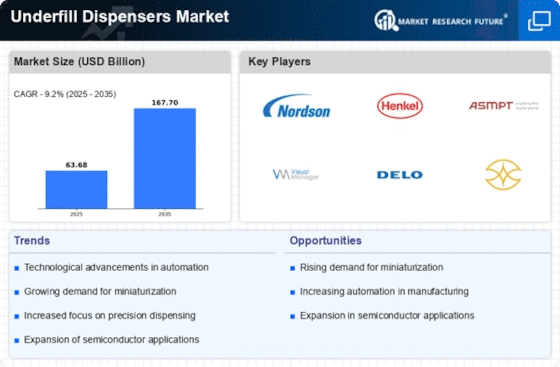

The Underfill Dispensers Market is witnessing several noteworthy market trends that are shaping the industry's trajectory. One prominent trend is the increasing demand for underfill dispensers in the automotive sector. As automotive electronics become more sophisticated and compact, the need for reliable underfilling of components has surged. Underfill dispensers play a crucial role in enhancing the durability and performance of electronic systems in vehicles, reflecting a growing trend in the automotive industry.

Another notable trend is the rising adoption of automation and robotics in manufacturing processes. Automation not only improves efficiency but also ensures precise and consistent underfilling of electronic components. As industries embrace Industry 4.0 and smart manufacturing practices, underfill dispensers with advanced automation features are becoming increasingly popular. This trend is driven by the desire to enhance production efficiency and reduce the likelihood of errors in underfilling processes.

The market is also witnessing a shift towards eco-friendly and sustainable underfill materials. As environmental concerns gain prominence, manufacturers are developing underfill dispensers that use materials with lower environmental impact. This trend aligns with broader industry efforts to adopt sustainable practices and reduce the environmental footprint of electronic manufacturing processes.

In response to the demand for miniaturized electronic devices, there is a growing trend of developing underfill dispensers with higher precision and flexibility. Manufacturers are focusing on designing dispensers that can accommodate the intricate requirements of smaller electronic components, addressing the industry's need for precision in underfilling processes. This trend is particularly evident in the consumer electronics sector, where devices continue to shrink in size while becoming more powerful.

The integration of Internet of Things (IoT) technologies is also influencing the underfill dispensers market. IoT-enabled dispensers offer real-time monitoring and control capabilities, allowing manufacturers to optimize their processes and minimize downtime. This trend reflects a broader industry shift towards incorporating IoT solutions to enhance operational efficiency and gather valuable data for process optimization.

Market trends also indicate an increasing emphasis on strategic collaborations and partnerships. Companies in the underfill dispensers market are forming alliances to leverage complementary strengths and enhance their market presence. Collaborations with key players in the electronics manufacturing industry, as well as with suppliers and distributors, are becoming integral to achieving a competitive edge in the market.

Furthermore, the underfill dispensers market is experiencing a trend towards customization and modular designs. Manufacturers are recognizing the diverse needs of different industries and end-users, prompting the development of dispensers that can be tailored to specific requirements. This trend allows companies to cater to a broader range of applications and industries, contributing to the versatility and adaptability of underfill dispensers.

The growing importance of quality control and assurance is another prevalent trend in the underfill dispensers market. Manufacturers are focusing on incorporating advanced inspection and monitoring features into their dispensers to ensure consistent and high-quality underfilling. This trend aligns with the industry's commitment to delivering reliable products that meet stringent quality standards.

Leave a Comment