Ultra-Thin Glass Market Summary

As per Market Research Future analysis, the Ultra-thin Glass Market Size was estimated at 20.71 USD Billion in 2024. The Ultra-thin Glass industry is projected to grow from 22.57 USD Billion in 2025 to 53.44 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 9.0% during the forecast period 2025 - 2035

Key Market Trends & Highlights

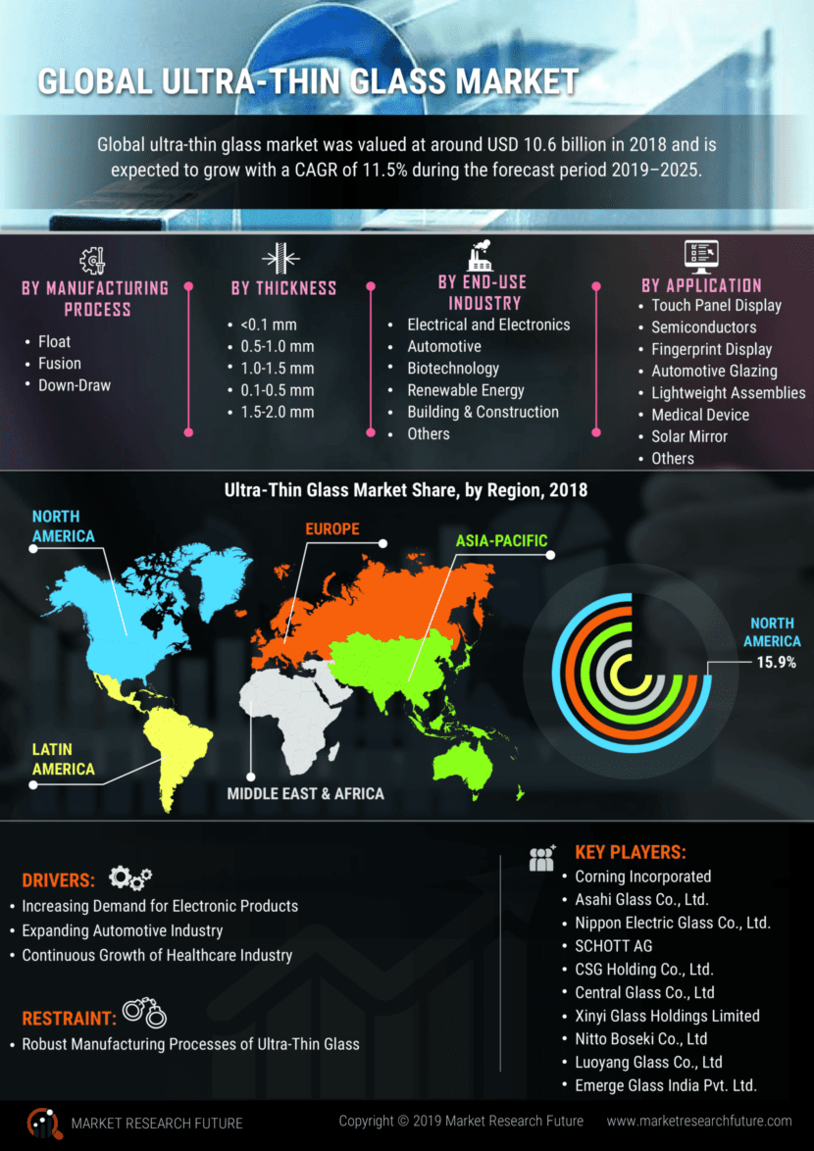

The Ultra-thin Glass Market is poised for substantial growth driven by technological advancements and rising consumer demand.

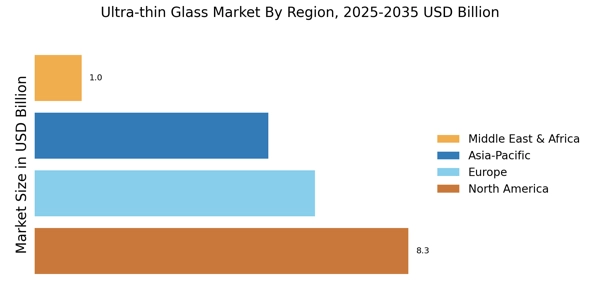

- North America remains the largest market for ultra-thin glass, driven by robust demand in electronics and automotive sectors.

- Asia-Pacific is emerging as the fastest-growing region, fueled by increasing investments in technology and manufacturing capabilities.

- The Float segment continues to dominate the market, while the Fusion segment is experiencing rapid growth due to innovative applications.

- Technological advancements in manufacturing and sustainability initiatives are key drivers propelling the market forward.

Market Size & Forecast

| 2024 Market Size | 20.71 (USD Billion) |

| 2035 Market Size | 53.44 (USD Billion) |

| CAGR (2025 - 2035) | 9.0% |

Major Players

Corning Inc (US), AGC Inc (JP), Schott AG (DE), Nippon Electric Glass Co Ltd (JP), Saint-Gobain (FR), Asahi Glass Co Ltd (JP), Xinyi Glass Holdings Ltd (HK), Guardian Glass (US)