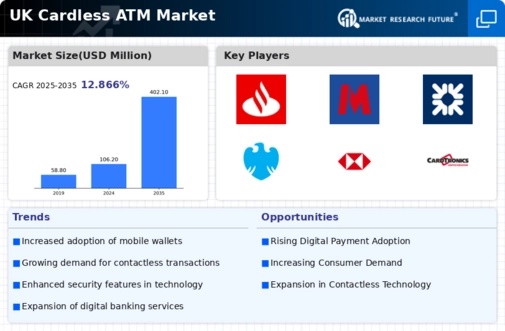

Consumer Demand for Convenience

Consumer preferences are shifting towards convenience, significantly impacting the cardless atm market. With the rise of digital banking, customers increasingly seek seamless and quick access to their funds. In the UK, surveys indicate that over 60% of consumers prefer using mobile apps for banking transactions, including cash withdrawals. This growing demand for convenience drives banks to adopt cardless atm solutions, which offer faster service and reduce wait times. As a result, the cardless atm market is poised for growth, as financial institutions strive to meet the evolving expectations of their clientele.

Rise of Contactless Payment Solutions

The rise of contactless payment solutions is a key driver for the cardless atm market. In the UK, contactless transactions have seen a remarkable increase, with over 50% of all card payments now being made via contactless methods. This trend extends to cardless atms, where users can withdraw cash without physical cards, using their mobile devices instead. The convenience and speed of contactless transactions appeal to a broad demographic, particularly younger consumers. As this trend continues, the cardless atm market is expected to grow, driven by the increasing acceptance of contactless technology.

Technological Advancements in Banking

The cardless atm market is experiencing a surge due to rapid technological advancements in banking. Innovations such as biometric authentication and mobile payment systems are enhancing user experience and security. In the UK, the integration of Near Field Communication (NFC) technology allows customers to withdraw cash using their smartphones, eliminating the need for physical cards. This shift is reflected in a reported increase of 30% in cardless transactions over the past year. As banks invest in these technologies, the cardless atm market is likely to expand, catering to a tech-savvy population that values convenience and efficiency.

Increased Focus on Financial Inclusion

Financial inclusion initiatives are gaining momentum in the UK, which is likely to bolster the cardless atm market. Many financial institutions are focusing on providing accessible banking solutions to underserved populations. Cardless atms can play a crucial role in this effort, as they allow individuals without traditional bank accounts to access cash through mobile applications. Recent studies suggest that enhancing access to financial services could increase participation in the banking system by up to 20%. As banks prioritize inclusion, the cardless atm market may see significant growth, addressing the needs of diverse customer segments.

Regulatory Support for Digital Transactions

Regulatory frameworks in the UK are increasingly supportive of digital transactions, which positively influences the cardless atm market. The Financial Conduct Authority (FCA) has implemented guidelines that encourage the adoption of innovative payment solutions, including cardless transactions. This regulatory backing fosters a secure environment for both consumers and financial institutions, promoting the growth of the cardless atm market. As compliance with these regulations becomes more streamlined, banks are likely to invest further in cardless technology, enhancing accessibility and security for users.