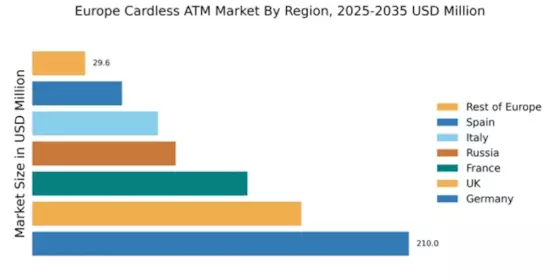

Germany : Strong Market Growth and Innovation

Germany holds a commanding market share of 210.0, representing a significant portion of the European cardless ATM landscape. Key growth drivers include a robust digital banking infrastructure, increasing consumer preference for contactless transactions, and supportive government initiatives promoting fintech innovation. Regulatory policies are evolving to enhance security and consumer protection, while investments in technology and infrastructure are paving the way for advanced ATM solutions.

UK : Innovation Meets Consumer Demand

The UK market, valued at 150.0, is characterized by rapid adoption of cardless ATM technology. Growth is driven by increasing smartphone penetration and a shift towards cashless transactions. Regulatory support from the Financial Conduct Authority (FCA) encourages innovation while ensuring consumer protection. The demand for seamless banking experiences is reshaping consumption patterns, with a focus on convenience and security.

France : Balancing Tradition and Innovation

France, with a market value of 120.0, is witnessing a gradual shift towards cardless ATM solutions. Growth drivers include a strong emphasis on digital banking and government initiatives aimed at enhancing financial inclusion. Regulatory frameworks are adapting to support new technologies while ensuring consumer safety. The demand for user-friendly interfaces is influencing consumption patterns, particularly among younger demographics.

Russia : Growth Amidst Economic Challenges

Russia's cardless ATM market, valued at 80.0, is emerging despite economic challenges. Key growth drivers include increasing urbanization and a growing preference for digital payment solutions. Government initiatives aimed at modernizing the banking sector are fostering innovation. Regulatory policies are evolving to accommodate new technologies, while infrastructure improvements are enhancing accessibility to financial services.

Italy : Cultural Shift Towards Digital Banking

Italy's market, valued at 70.0, is experiencing a cultural shift towards cardless ATM usage. Growth is driven by increasing smartphone adoption and a rising demand for contactless transactions. Regulatory support from the Bank of Italy is crucial in promoting secure digital banking practices. The competitive landscape features major players like NCR and Diebold Nixdorf, focusing on enhancing user experience and security.

Spain : Embracing Digital Payment Solutions

Spain's cardless ATM market, valued at 50.0, is on the rise, driven by a growing preference for digital payment methods. Key growth factors include government initiatives promoting fintech and a strong push towards cashless transactions. Regulatory frameworks are adapting to support innovation while ensuring consumer protection. Major cities like Madrid and Barcelona are key markets, with significant investments in ATM technology.

Rest of Europe : Varied Market Dynamics Across Regions

The Rest of Europe, with a market value of 29.55, presents diverse opportunities in the cardless ATM sector. Growth drivers vary by country, influenced by local regulations and consumer preferences. Some regions are rapidly adopting digital banking solutions, while others are still transitioning. The competitive landscape includes both local and international players, each adapting to unique market conditions and consumer demands.