Rising Avian Influenza Incidence

The avian influenza-vaccine market is experiencing growth due to the increasing incidence of avian influenza outbreaks in the UK. Reports indicate that the frequency of these outbreaks has escalated, leading to heightened awareness among poultry farmers and the general public regarding the importance of vaccination. The UK government has implemented measures to control these outbreaks, which has resulted in a surge in demand for effective vaccines. In 2023, the poultry sector faced significant losses, estimated at £50 million, due to avian influenza, prompting farmers to invest in vaccination programs. This trend is likely to continue, as the avian influenza-vaccine market adapts to the evolving landscape of disease management and prevention.

Government Initiatives and Support

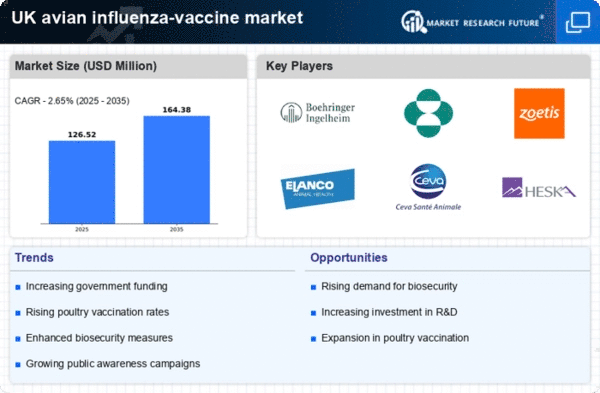

The avian influenza-vaccine market is bolstered by various government initiatives aimed at enhancing biosecurity and disease prevention in the poultry industry. The UK government has introduced funding programs and grants to support vaccine development and distribution. These initiatives are designed to mitigate the economic impact of avian influenza outbreaks, which have previously resulted in substantial financial losses for farmers. In 2024, the government allocated £10 million to research and development in the avian influenza-vaccine market, indicating a strong commitment to improving public health and agricultural sustainability. Such support is likely to foster innovation and increase the availability of vaccines, thereby driving market growth.

Technological Advancements in Vaccine Development

Technological advancements are playing a crucial role in shaping the avian influenza-vaccine market. Innovations in vaccine formulation and delivery methods are enhancing the efficacy and safety of vaccines. For instance, the development of recombinant vaccines and adjuvants has shown promise in improving immune responses in poultry. The avian influenza-vaccine market is witnessing increased collaboration between research institutions and pharmaceutical companies, leading to the introduction of novel vaccine candidates. In 2025, it is anticipated that the market will see a 15% increase in the adoption of these advanced vaccines, reflecting a shift towards more effective disease management strategies.

Consumer Awareness and Demand for Safe Poultry Products

Consumer awareness regarding food safety and animal health is driving the avian influenza-vaccine market. As consumers become more informed about the risks associated with avian influenza, there is a growing demand for poultry products that are certified as safe and free from the virus. This trend is influencing poultry producers to prioritize vaccination as a means of ensuring product safety. The avian influenza-vaccine market is responding to this demand by promoting the benefits of vaccination in maintaining flock health and preventing disease transmission. In 2025, it is expected that the market will expand by 20% as consumer preferences shift towards vaccinated poultry products.

International Trade Regulations and Export Opportunities

The avian influenza-vaccine market is influenced by international trade regulations that govern the export of poultry products. The UK has established stringent biosecurity measures to comply with international standards, which has implications for the vaccination of poultry. As countries impose regulations on the import of poultry products from regions affected by avian influenza, the demand for vaccines is likely to increase. The avian influenza-vaccine market is positioned to benefit from these export opportunities, as vaccinated poultry can meet the requirements of international markets. In 2025, it is projected that the market will see a 10% growth driven by increased exports of vaccinated poultry products.