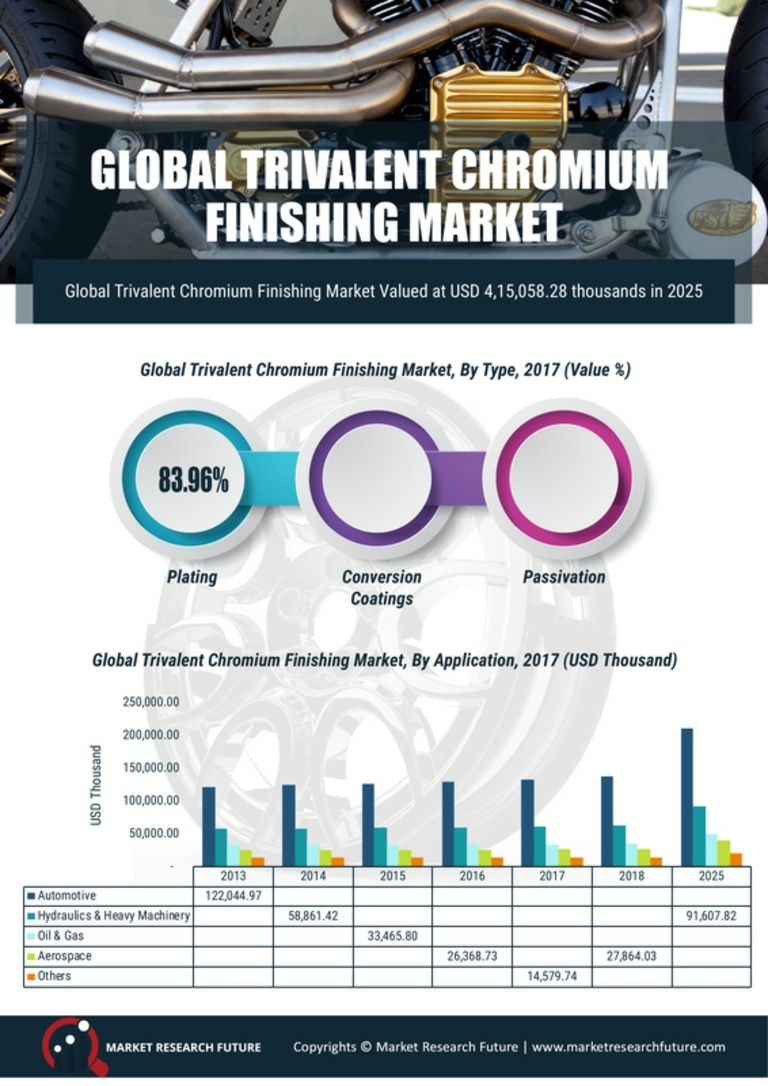

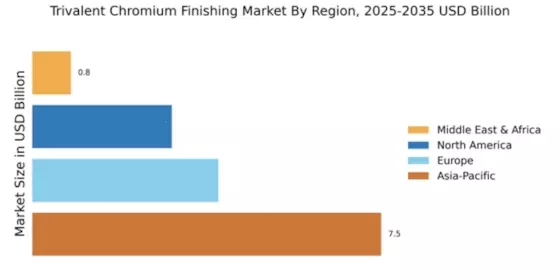

Market Growth Projections

The Global Trivalent Chromium Finishing Market Industry is poised for substantial growth, with projections indicating a market value of 290.7 USD Billion in 2024 and an anticipated increase to 551.3 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate of 5.99% from 2025 to 2035, reflecting the increasing adoption of trivalent chromium technologies across various sectors. The market's expansion is likely driven by factors such as regulatory support, technological advancements, and rising consumer demand for sustainable and high-quality finishing solutions. These projections underscore the industry's potential as it adapts to evolving market dynamics.

Rising Automotive Production and Sales

The resurgence of the automotive sector significantly influences the Global Trivalent Chromium Finishing Market Industry. With global automotive production projected to increase, the demand for durable and aesthetically pleasing components rises correspondingly. Trivalent chromium finishing offers excellent corrosion resistance, making it an attractive choice for automotive manufacturers. As the market evolves, the value is expected to reach 551.3 USD Billion by 2035, driven by the need for high-performance coatings in vehicles. This trend indicates a shift towards more sustainable and efficient finishing solutions, aligning with the industry's broader goals of reducing environmental impact.

Growing Demand for Eco-Friendly Coatings

The increasing emphasis on environmental sustainability drives the Global Trivalent Chromium Finishing Market Industry. As industries seek alternatives to hexavalent chromium, which poses significant health risks, trivalent chromium emerges as a safer option. This shift is particularly evident in sectors such as automotive and aerospace, where regulatory pressures and consumer preferences favor eco-friendly solutions. The market's value is projected to reach 290.7 USD Billion in 2024, reflecting a robust demand for sustainable finishing processes. Companies adopting trivalent chromium technologies not only comply with regulations but also enhance their brand image, appealing to environmentally conscious consumers.

Regulatory Support for Sustainable Practices

Government regulations promoting sustainable manufacturing practices bolster the Global Trivalent Chromium Finishing Market Industry. Many countries are implementing stricter environmental standards, encouraging industries to transition from harmful substances like hexavalent chromium to safer alternatives. This regulatory landscape not only fosters innovation but also incentivizes companies to adopt trivalent chromium technologies. As a result, manufacturers are likely to invest in research and development to enhance their finishing processes. The growing alignment between regulatory frameworks and market demands suggests a favorable environment for the expansion of trivalent chromium finishing solutions.

Technological Advancements in Finishing Processes

Innovations in trivalent chromium finishing technologies contribute to the expansion of the Global Trivalent Chromium Finishing Market Industry. Advanced techniques, such as electroplating and chemical vapor deposition, improve the efficiency and quality of coatings. These advancements enable manufacturers to achieve superior corrosion resistance and aesthetic appeal, which are crucial in competitive markets. As industries increasingly prioritize product longevity and performance, the adoption of these technologies is likely to accelerate. The anticipated compound annual growth rate of 5.99% from 2025 to 2035 underscores the potential for growth driven by technological enhancements in finishing processes.

Increased Focus on Product Aesthetics and Durability

The growing consumer preference for high-quality, aesthetically pleasing products drives the Global Trivalent Chromium Finishing Market Industry. Industries such as electronics, jewelry, and consumer goods increasingly prioritize surface finishes that enhance both appearance and durability. Trivalent chromium finishing provides a unique combination of visual appeal and protective qualities, making it a preferred choice for manufacturers. As consumer expectations evolve, companies are likely to invest in advanced finishing technologies to meet these demands. This trend indicates a potential for sustained growth in the market, as manufacturers strive to deliver products that align with consumer desires for both beauty and longevity.