Transparent Plastics Size

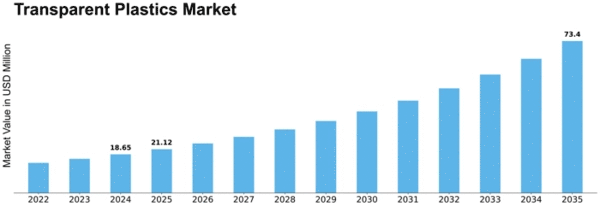

Transparent Plastics Market Growth Projections and Opportunities

The Transparent Plastics Market is significantly influenced by various market factors that shape its dynamics and growth trajectory. One of the primary drivers is the increasing demand for lightweight and durable materials across industries such as packaging, automotive, and electronics. Transparent plastics, with their versatile properties, are well-suited for applications where transparency, impact resistance, and cost-effectiveness are crucial. Moreover, the growing awareness and emphasis on sustainable practices have led to a surge in the adoption of transparent plastics as they are recyclable and contribute to reducing the overall environmental impact.

Technological advancements play a pivotal role in the Transparent Plastics Market. Continuous innovations in plastic processing technologies, such as extrusion and injection molding, contribute to the development of transparent plastics with enhanced properties. This, in turn, expands the range of applications and opens up new opportunities for market players. Furthermore, the integration of additives and modifiers into transparent plastics to improve characteristics like UV resistance, flame retardancy, and chemical resistance is a key factor influencing market growth. Companies investing in research and development to stay ahead in the competitive landscape contribute to the evolution of advanced transparent plastic materials.

Global economic conditions significantly impact the Transparent Plastics Market. Economic growth and industrialization drive the demand for transparent plastics, especially in emerging economies. As these nations witness increased manufacturing activities and a rise in consumer spending, the need for transparent plastics in packaging, construction, and consumer goods rises accordingly. On the other hand, economic downturns can lead to a temporary slowdown in market growth as industries may cut back on production and investment.

Regulatory factors also play a crucial role in shaping the Transparent Plastics Market. Governments and international bodies have been implementing regulations to address environmental concerns associated with plastic use. Stringent norms related to single-use plastics, recycling targets, and sustainable practices influence the manufacturing and consumption patterns of transparent plastics. Companies that align with these regulations by adopting eco-friendly production methods and promoting recyclability gain a competitive edge and contribute to the overall sustainability of the market.

Consumer preferences and lifestyle changes are key determinants influencing the demand for transparent plastics. With the increasing focus on aesthetics and product visibility, consumers prefer transparent packaging in the food and beverage industry, thereby driving market growth. Additionally, the rising trend of online shopping has boosted the demand for transparent plastic packaging to showcase products attractively. As consumers become more environmentally conscious, there is a growing preference for transparent plastics with eco-friendly attributes, pushing manufacturers to develop sustainable alternatives.

The Transparent Plastics Market is also shaped by the competitive landscape and industry collaborations. Intense competition among key players results in continuous product innovation and strategic alliances to gain a larger market share. Mergers, acquisitions, and partnerships are common strategies employed by companies to strengthen their market position and expand their product portfolios. These collaborations contribute to technological advancements, cost efficiencies, and a broader market reach.

Leave a Comment