Regulatory Support

Regulatory bodies are increasingly providing support for the Transcatheter Market, facilitating the approval process for new devices and technologies. Streamlined regulatory pathways, such as the FDA's Breakthrough Devices Program, expedite the review of innovative transcatheter products. This support is crucial in addressing the urgent need for effective treatments in cardiovascular diseases, which are among the leading causes of mortality worldwide. The approval of new transcatheter devices has been on the rise, with a reported increase of 25% in approvals over the past three years. Such regulatory encouragement not only fosters innovation but also enhances market confidence, thereby contributing to the expansion of the Transcatheter Market.

Technological Innovations

The Transcatheter Market is experiencing a surge in technological innovations that enhance the efficacy and safety of transcatheter procedures. Advancements in imaging technologies, such as 3D echocardiography and fluoroscopy, allow for more precise interventions. Additionally, the development of novel transcatheter devices, including valves and stents, has expanded treatment options for patients with complex cardiovascular conditions. According to recent data, the market for transcatheter heart valves alone is projected to reach USD 12 billion by 2026, indicating a robust growth trajectory. These innovations not only improve patient outcomes but also drive the adoption of transcatheter procedures, thereby propelling the overall growth of the Transcatheter Market.

Patient-Centric Approaches

The Transcatheter Market is witnessing a shift towards patient-centric approaches, which prioritize the needs and preferences of patients in treatment decisions. This trend is characterized by increased patient awareness and education regarding transcatheter options, leading to higher demand for minimally invasive procedures. Healthcare providers are increasingly adopting shared decision-making models, which empower patients to participate actively in their treatment choices. As a result, the acceptance of transcatheter procedures is on the rise, with studies indicating that patient satisfaction rates for these interventions are significantly higher compared to traditional surgeries. This focus on patient-centered care is likely to enhance the growth of the Transcatheter Market, as more individuals seek out these innovative treatment options.

Investment in Research and Development

Investment in research and development is a crucial driver for the Transcatheter Market, as it fosters innovation and the introduction of new technologies. Pharmaceutical and medical device companies are allocating substantial resources to R&D efforts aimed at developing advanced transcatheter solutions. This investment is reflected in the increasing number of clinical trials and studies focused on transcatheter procedures, which have seen a 30% rise in the last five years. Such commitment to R&D not only leads to the creation of more effective devices but also enhances the overall credibility of the Transcatheter Market. As new products emerge, they are likely to attract further investment and interest, thereby sustaining the momentum of market growth.

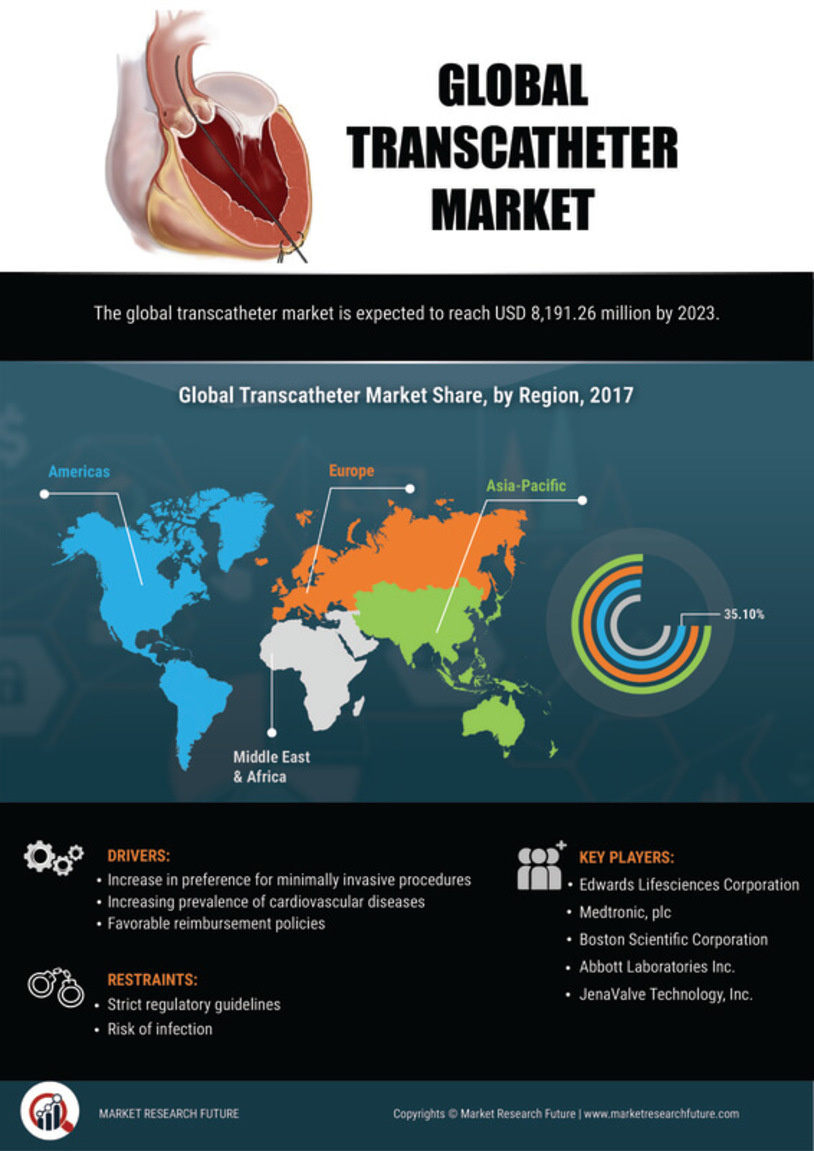

Increasing Prevalence of Cardiovascular Diseases

The rising prevalence of cardiovascular diseases is a primary driver of the Transcatheter Market. As populations age and lifestyle-related risk factors become more prevalent, the demand for effective treatment options continues to grow. Data indicates that cardiovascular diseases account for approximately 31% of all global deaths, underscoring the urgent need for innovative solutions. Transcatheter Market procedures, which are less invasive than traditional surgical methods, are becoming increasingly favored by both patients and healthcare providers. This trend is expected to drive the market, with estimates suggesting that the transcatheter heart valve segment alone could grow at a compound annual growth rate of 15% through 2028, reflecting the critical role of transcatheter technologies in addressing this health crisis.