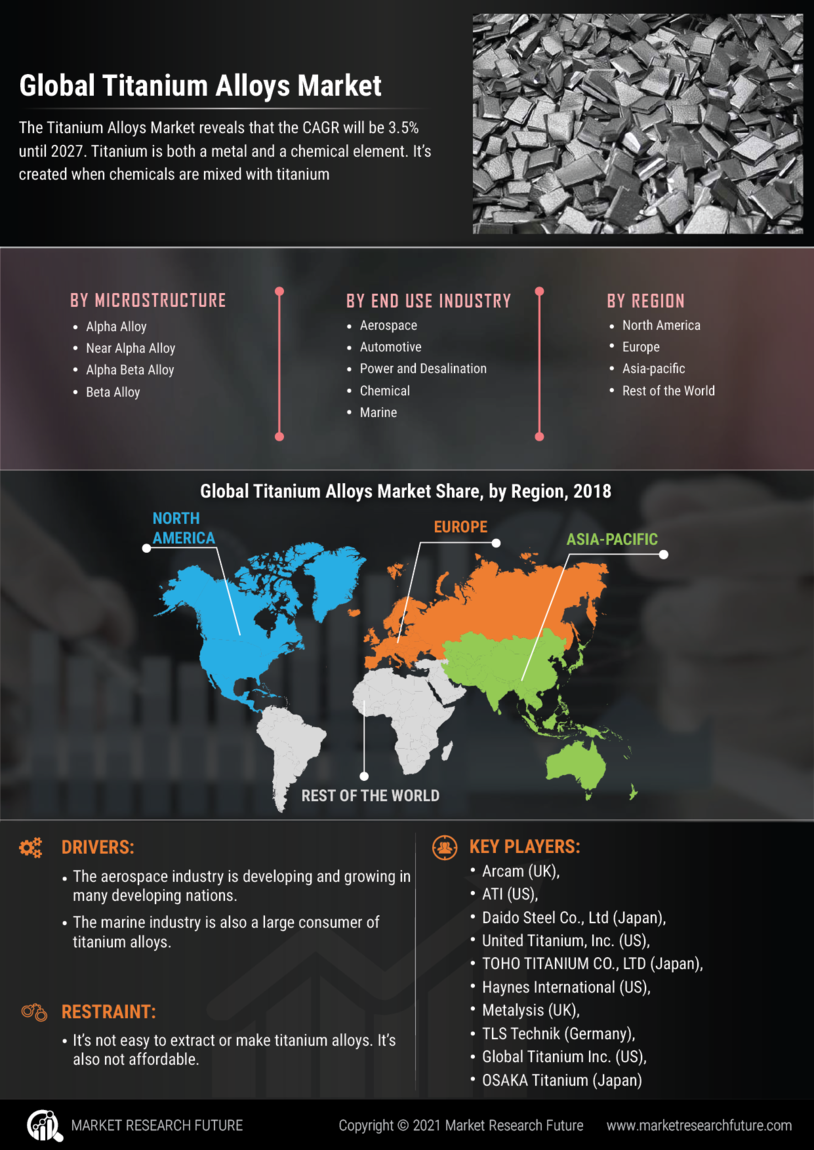

Titanium Alloys Market Summary

As per MRFR analysis, the Titanium Alloys Market Size was estimated at 10853.82 USD Million in 2024. The Titanium Alloys industry is projected to grow from 11371.77 USD Million in 2025 to 18125.14 USD Million by 2035, exhibiting a compound annual growth rate (CAGR) of 4.77 during the forecast period 2025 - 2035.

Key Market Trends & Highlights

The Titanium Alloys Market is poised for robust growth driven by diverse applications and technological advancements.

- The aerospace sector continues to witness increased adoption of titanium alloys, solidifying its position as the largest market segment.

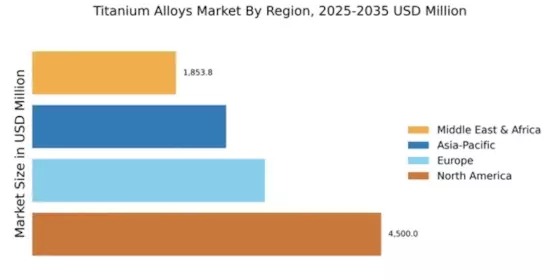

- Asia-Pacific emerges as the fastest-growing region, reflecting a surge in demand for titanium alloys across various industries.

- Advancements in manufacturing techniques are enhancing the efficiency and performance of titanium alloys, particularly in medical applications.

- Rising demand in the automotive industry and increased investment in aerospace innovations are key drivers propelling market growth.

Market Size & Forecast

| 2024 Market Size | 10853.82 (USD Million) |

| 2035 Market Size | 18125.14 (USD Million) |

| CAGR (2025 - 2035) | 4.77% |

Major Players

Timet (US), Alcoa (US), VSMPO-AVISMA (RU), ATI (US), Haynes International (US), Carpenter Technology (US), Special Metals (US), Zhejiang Jinsheng (CN), Baoji Titanium Industry (CN)