Spain Metal Implants Medical Alloys Market Overview

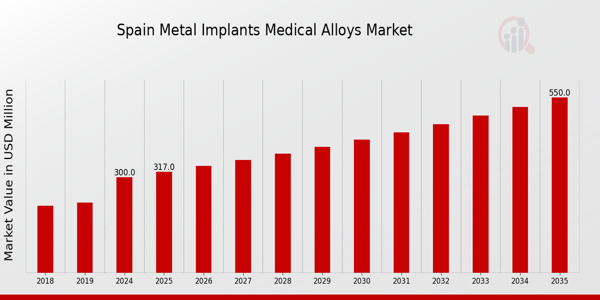

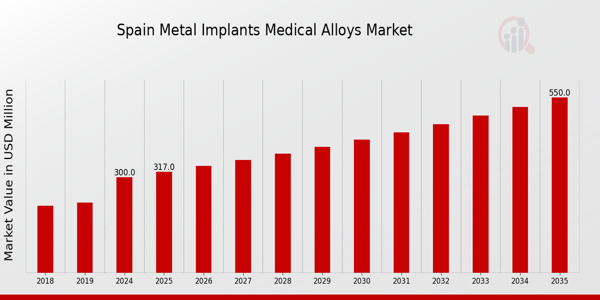

As per MRFR analysis, the Spain Metal Implants Medical Alloys Market Size was estimated at 229.42 (USD Million) in 2023. The Spain Metal Implants Medical Alloys Market Industry is expected to grow from 300 (USD Million) in 2024 to 550 (USD Million) by 2035. The Spain Metal Implants Medical Alloys Market CAGR (growth rate) is expected to be around 5.665% during the forecast period (2025 - 2035).

Key Spain Metal Implants Medical Alloys Market Trends Highlighted

The Spain Metal Implants Medical Alloys Market is experiencing several significant trends driven by various factors. A key market driver is the increasing aging population in Spain, which leads to a higher demand for orthopedic and dental implants. According to the Spanish National Institute of Statistics, there has been a rise in the proportion of senior citizens, resulting in greater healthcare needs, particularly in joint replacement and dental reconstructive procedures.

Additionally, advancements in metal alloy technology are contributing to improved implant performance, leading to enhanced patient outcomes. Opportunities within the Spanish market include the growing focus on biocompatible materials and personalized solutions, which are gaining traction among manufacturers and healthcare providers. This trend is propelled by the demand for tailored implants that match patient anatomy, ensuring better integration and longevity.

Moreover, the Spanish government's support in promoting research and development initiatives further fosters innovation in medical alloys, allowing companies to explore new possibilities in implant designs. In recent times, there has been a noticeable shift towards minimally invasive surgical techniques, which require innovative metal implant designs. This shift not only elevates the quality of care but also attracts more healthcare providers to invest in advanced alloys that provide better mechanical properties and patient compatibility.

Spain's commitment to improving healthcare outcomes and maintaining high standards in medical technology adoption is crucial in shaping the market dynamics for metal implants. Embracing these trends can lead to notable advancements in the medical sector, positioning Spain as a key player in the global metal implants market.

Source: Primary Research, Secondary Research, Market Research Future Database and Analyst Review

Spain Metal Implants Medical Alloys Market Drivers

Increasing Demand for Orthopedic Procedures

An aging population and the increasing incidence of musculoskeletal problems are driving a significant increase in the demand for orthopaedic operations in the Spain Metal Implants Medical Alloys Market Industry. Approximately 22% of Spanish citizens are over 65, and they are far more vulnerable to diseases like osteoporosis and arthritis, according to the Spanish Ministry of Health. The need for different orthopaedic implants is therefore anticipated to increase, especially for metal alloys used in joint replacements and fracture fixation devices.

The expansion of the Spain Metal Implants Medical Alloys Market is also being driven by improvements in the biocompatibility and mechanical qualities of metal alloys brought about by advances in material science in the Spanish orthopaedic industry. With their emphasis on implant technology research and development, major companies like Medtronic and Stryker are poised to take advantage of this expanding trend and support the expansion of the Spanish market as a whole.

Technological Advancements in Medical Alloys

The advancement of innovative medical alloys specifically designed for implants is a significant driver of growth in the Spain Metal Implants Medical Alloys Market Industry. Ongoing Research and Development initiatives are leading to the creation of superior metal alloys with enhanced performance characteristics, such as improved corrosion resistance and weight reduction. As outlined by the Spanish National Center for Biotechnology, recent studies suggest that the integration of titanium and zirconium-based alloys increases the success rates of implant surgeries by 15%.

Companies such as Bayer and Johnson and Johnson are making substantial investments in these advancements, aiming to establish their cutting-edge technologies within the Spanish market. Such innovations not only cater to the evolving needs of healthcare providers but also drive competitive dynamics, boosting the market's future prospects.

Government Support for Medical Infrastructure Development

The Spanish government plays a crucial role in expanding the medical infrastructure, which directly impacts the Spain Metal Implants Medical Alloys Market Industry. Recent governmental policies have focused on enhancing healthcare frameworks and allocating resources for the modernization of hospitals and clinics. For instance, a government report highlighted a commitment to increase healthcare spending by 10% over the next five years. This initiative is projected to improve access to advanced medical technologies, including metal implants, thereby increasing the adoption of such technologies within the healthcare system.

Furthermore, the collaboration between public health institutions and private sector leaders such as Biomet and Medtronic ensures that portable and innovative surgical solutions become readily available, emphasizing the need for quality medical alloys in Spain.

Spain Metal Implants Medical Alloys Market Segment Insights

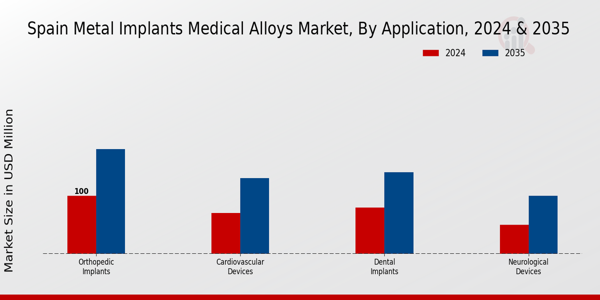

Metal Implants Medical Alloys Market Application Insights

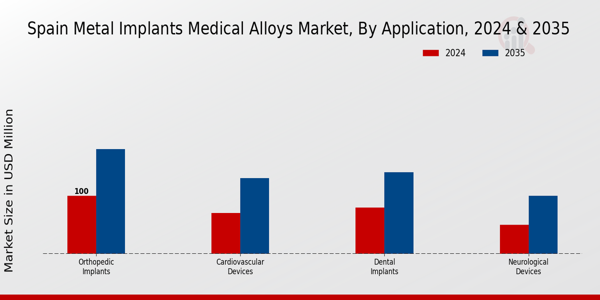

The Application segment of the Spain Metal Implants Medical Alloys Market encompasses a variety of crucial components, reflecting the dynamic nature of the healthcare landscape in Spain. Orthopedic Implants hold a significant portion of this segment due to the increasing incidence of bone-related ailments and the aging population, who predominantly require replacements or support devices to enhance mobility.

With advancements in metallurgy and materials science, the development of customized orthopedic solutions using medical alloys is also gaining traction, thereby boosting market growth. Dental Implants are another vital sub-segment, primarily driven by rising awareness about oral health and the growing number of dental procedures performed each year. These implants offer long-term solutions for tooth loss, and innovations in biocompatible materials are contributing to their increased adoption throughout Spain.

In the realm of Cardiovascular Devices, the importance is amplified by the rise in cardiovascular diseases within the population. The selection of medical alloys designed to withstand the hostile environment within the human body has advanced significantly, ensuring improved longevity and functionality, which is vital for patients with heart-related issues. Neurological Devices, although comprising a smaller portion of the market, are crucial as they provide solutions for conditions such as epilepsy, Parkinson’s disease, and brain injuries.

The integration of sophisticated technologies and improved alloys into these devices is essential for enhancing the quality of life for patients suffering from neurological disorders. Overall, the diverse applications of metal implants in the medical field reveal a promising landscape characterized by innovation and a focus on addressing varying patient needs, further reflecting the essential role of these devices in contemporary medicine within Spain.

Source: Primary Research, Secondary Research, Market Research Future Database and Analyst Review

Metal Implants Medical Alloys Market Material Type Insights

The Spain Metal Implants Medical Alloys Market shows a diverse range of materials that play a crucial role in the functionality and reliability of medical implants. Among these, Titanium Alloys are highly preferred for their remarkable biocompatibility and strength-to-weight ratio, making them ideal for orthopedic and dental applications. Cobalt Alloys, known for their wear resistance and corrosion resistance, are significant in the production of high-performance implants, especially in joint replacements.

Additionally, Stainless Steel remains a dominant choice due to its strength, affordability, and ease of fabrication, often utilized in various surgical instruments and orthopedic devices. Meanwhile, Magnesium Alloys are gaining traction due to their favorable properties, such as lightweight and natural biodegradability, which align with the growing demand for biodegradable implants in the medical sector. The ongoing advancements in material science and technology, as well as the increasing demand for personalized healthcare solutions, are expected to drive innovative applications in this market segment.

The strong growth in Spain's healthcare sector also fosters opportunities for further development and adoption of these materials in medical devices.

Metal Implants Medical Alloys Market End Use Insights

The Spain Metal Implants Medical Alloys Market presents a diverse segmentation, particularly within its End Use category, which plays a crucial role in enhancing patient care and driving advancements in medical technology. Hospitals are significant contributors, leveraging metal implants for surgeries that necessitate precision and reliability, thus establishing a foundation for excellent patient outcomes. Clinics, on the other hand, increasingly incorporate metal implants in outpatient procedures, ensuring efficient treatment for a variety of conditions.

Research Laboratories also hold a vital position as they explore innovative applications and improvements in metal alloy technology, further propelling the Spain Metal Implants Medical Alloys Market toward better performance and efficacy. The collaborative efforts among these entities foster an environment rich in research and practical application, enabling the market to adapt to changing healthcare demands while addressing challenges like material biocompatibility and cost-efficiency.

Spain Metal Implants Medical Alloys Market Key Players and Competitive Insights

The Spain Metal Implants Medical Alloys Market is a dynamic and rapidly evolving sector characterized by various competitive factors influencing its growth and development. The market is driven by the increasing demand for advanced medical devices and implants that utilize metal alloys due to their favorable properties, such as biocompatibility and mechanical strength. This competitive landscape features multiple players vying for market share through innovation, strategic partnerships, and advancements in technology.

Companies are focused on enhancing their product offerings to meet the specific needs of healthcare providers and patients, which is spurred by a rise in orthopedic surgeries and the aging population. The presence of established and emerging firms contributes to a diverse ecosystem where competition fosters continuous improvement and the introduction of new solutions tailored to the local market.

In the context of the Spain Metal Implants Medical Alloys Market, NuVasive is recognized for its strong positioning and notable strengths. The company is well-regarded for its focus on providing innovative spinal surgery solutions, which include metal implants made from advanced alloys known for their durability and performance. NuVasive's commitment to research and development ensures that it remains at the forefront of technological advancements in spinal health.

Its tailored marketing strategy allows it to effectively reach healthcare professionals and institutions across Spain, establishing a strong brand presence within the market. Additionally, partnerships with local distributors and a customer-centric approach enable NuVasive to garner trust and enhance its competitive advantage in the region. Boston Scientific, another key player in the Spain Metal Implants Medical Alloys Market, has a well-established reputation for delivering a wide range of medical devices, including those specifically designed for use in interventional procedures.

The company offers various products, such as stents and orthopedic implants, crafted from innovative metal alloys that enhance biocompatibility and functionality. Boston Scientific's strong market presence in Spain is bolstered by a robust distribution network and strategic collaborations with healthcare institutions, ensuring its products are readily available to meet the needs of practitioners. The company's focus on continuous innovation, backed by significant investments in research and development, facilitates the advancement of new technologies and therapies.

Boston Scientific's strategic mergers and acquisitions have further solidified its position within the Spanish market, allowing it to diversify its offerings and expand its operational capabilities, ultimately enhancing its competitive stance in the metal implants sector.

Key Companies in the Spain Metal Implants Medical Alloys Market Include

- NuVasive

- Boston Scientific

- Medtronic

- MediSieve

- RTI Surgical

- Johnson & Johnson

- Stryker

- Smith & Nephew

- Conmed

- Intrauma

- KLS Martin

- Olympus

- Zimmer Biomet

- B. Braun

- Aesculap

Spain Metal Implants Medical Alloys Market Industry Developments

In recent months, the Spain Metal Implants Medical Alloys Market has been active, with notable developments, including advancements in alloy technology and increasing regulatory approvals for new orthopedic devices. Companies like Medtronic and Boston Scientific are focusing on innovation in biocompatible materials to enhance implant performance. In June 2023, Stryker announced an expansion of its manufacturing capabilities in Spain, intending to meet the growing demand for orthopedic implants.

Furthermore, in July 2023, Johnson and Johnson completed the acquisition of a Spanish-based start-up specializing in additive manufacturing for medical devices, enhancing its product pipeline in the region. The market has been witnessing consistent growth, driven by an aging population and an increase in orthopedic procedures, which has positively impacted companies like Zimmer Biomet and Smith and Nephew. Over the last few years, the Spanish government has increased investment in healthcare infrastructure, providing a conducive environment for market players. Overall, these developments indicate a robust demand for metal implants in Spain's increasingly dynamic healthcare landscape.

Spain Metal Implants Medical Alloys Market Segmentation Insights

Metal Implants Medical Alloys Market Application Outlook

- Orthopedic Implants

- Dental Implants

- Cardiovascular Devices

- Neurological Devices

Metal Implants Medical Alloys Market Material Type Outlook

- Titanium Alloys

- Cobalt Alloys

- Stainless Steel

- Magnesium Alloys

Metal Implants Medical Alloys Market End Use Outlook

- Hospitals

- Clinics

- Research Laboratories

| Report Attribute/Metric Source: |

Details |

| MARKET SIZE 2023 |

229.42(USD Million) |

| MARKET SIZE 2024 |

300.0(USD Million) |

| MARKET SIZE 2035 |

550.0(USD Million) |

| COMPOUND ANNUAL GROWTH RATE (CAGR) |

5.665% (2025 - 2035) |

| REPORT COVERAGE |

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| BASE YEAR |

2024 |

| MARKET FORECAST PERIOD |

2025 - 2035 |

| HISTORICAL DATA |

2019 - 2024 |

| MARKET FORECAST UNITS |

USD Million |

| KEY COMPANIES PROFILED |

NuVasive, Boston Scientific, Medtronic, W. L. Gore & Associates, C. R. Bard, Johnson & Johnson, MediCor, Stryker, Smith & Nephew, B. Braun Melsungen, Olympus Corporation, DePuy Synthes, Abbott Laboratories, Zimmer Biomet, Aesculap |

| SEGMENTS COVERED |

Application, Material Type, End Use |

| KEY MARKET OPPORTUNITIES |

Growing demand for orthopedic implants, Advancements in material technology, Increased healthcare expenditure, Rising geriatric population, Expansion of dental implant market |

| KEY MARKET DYNAMICS |

Rising geriatric population, Increasing orthopedic procedures, Advancements in alloy technology, Growing sports injuries, Demand for customized implants |

| COUNTRIES COVERED |

Spain |

Frequently Asked Questions (FAQ):

The Spain Metal Implants Medical Alloys Market is expected to be valued at 300.0 USD Million in 2024.

By 2035, the market is projected to grow to 550.0 USD Million.

The market is expected to grow at a CAGR of 5.665% from 2025 to 2035.

In 2024, orthopedic implants are expected to dominate the market with a value of 100.0 USD Million.

The dental implants segment is projected to reach a market size of 140.0 USD Million by 2035.

Key players include Medtronic, Johnson & Johnson, Stryker, and Zimmer Biomet among others.

Cardiovascular devices are expected to be valued at 70.0 USD Million in 2024.

The neurological devices segment is expected to grow to 100.0 USD Million by 2035.

Growing demand for advanced medical implants and technological advancements in manufacturing are key trends.

Challenges include regulatory hurdles and competition from alternative materials in the market.