Thyristor Rectifier Electric Locomotive Size

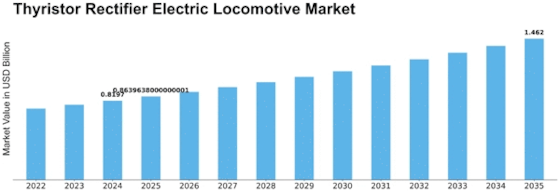

Thyristor Rectifier Electric Locomotive Market Growth Projections and Opportunities

The Thyristor Rectifier Electric Locomotive Market is influenced by several market factors that play a crucial role in shaping its dynamics. One of the key determinants is technological advancements. As new and more efficient thyristor rectifier technologies emerge, electric locomotives can benefit from enhanced performance, energy efficiency, and reduced maintenance costs. Manufacturers in the market are constantly investing in research and development to stay at the forefront of these technological innovations, giving rise to a competitive landscape where companies strive to offer the most cutting-edge solutions.

Another significant market factor is the regulatory environment. Government regulations and policies regarding emissions, energy efficiency, and sustainable transportation have a profound impact on the Thyristor Rectifier Electric Locomotive Market. As countries around the world prioritize environmental sustainability, there is an increasing demand for electric locomotives that produce fewer emissions compared to traditional diesel-powered counterparts. This trend is driving manufacturers to develop and market thyristor rectifier electric locomotives that align with stringent environmental standards.

Market demand is a critical factor influencing the Thyristor Rectifier Electric Locomotive Market. The growing awareness of environmental issues and the need for cleaner transportation options have led to an increasing demand for electric locomotives globally. Moreover, the expanding railway infrastructure in emerging economies contributes to the market growth. The demand for reliable and energy-efficient transportation solutions is encouraging manufacturers to invest in the development and production of thyristor rectifier electric locomotives to meet the evolving needs of the market.

Economic factors also play a pivotal role in shaping the Thyristor Rectifier Electric Locomotive Market. The overall economic health of a region or country can impact the market's growth and development. Economic stability often correlates with increased investments in transportation infrastructure, positively influencing the demand for electric locomotives. Additionally, factors such as fuel prices and the total cost of ownership of locomotives can sway purchasing decisions, making electric locomotives more attractive when fuel costs are high.

Competitive forces within the market are crucial market factors that drive innovation and influence pricing strategies. As major players compete for market share, there is a constant push for product differentiation and cost-effective solutions. This competition fosters the development of advanced thyristor rectifier electric locomotives that cater to specific customer needs, creating a diverse range of offerings in the market.

Global economic trends also impact the Thyristor Rectifier Electric Locomotive Market. Fluctuations in currency exchange rates, trade policies, and geopolitical events can influence the cost of raw materials and impact the overall manufacturing costs for electric locomotives. Manufacturers must navigate these external economic factors to maintain competitiveness and ensure profitability.

Leave a Comment