Sustainability Initiatives

The increasing emphasis on sustainability is a pivotal driver for the Thin Wall Packaging Market. As consumers become more environmentally conscious, companies are compelled to adopt eco-friendly packaging solutions. Thin wall packaging, often made from recyclable materials, aligns with these sustainability goals. In fact, the market for sustainable packaging is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 5% in the coming years. This shift not only meets consumer demand but also helps companies reduce their carbon footprint, thereby enhancing their brand image. Furthermore, regulatory pressures are mounting, as governments worldwide implement stricter guidelines on packaging waste. This trend indicates that businesses in the Thin Wall Packaging Market must innovate and adapt to remain competitive.

Technological Advancements

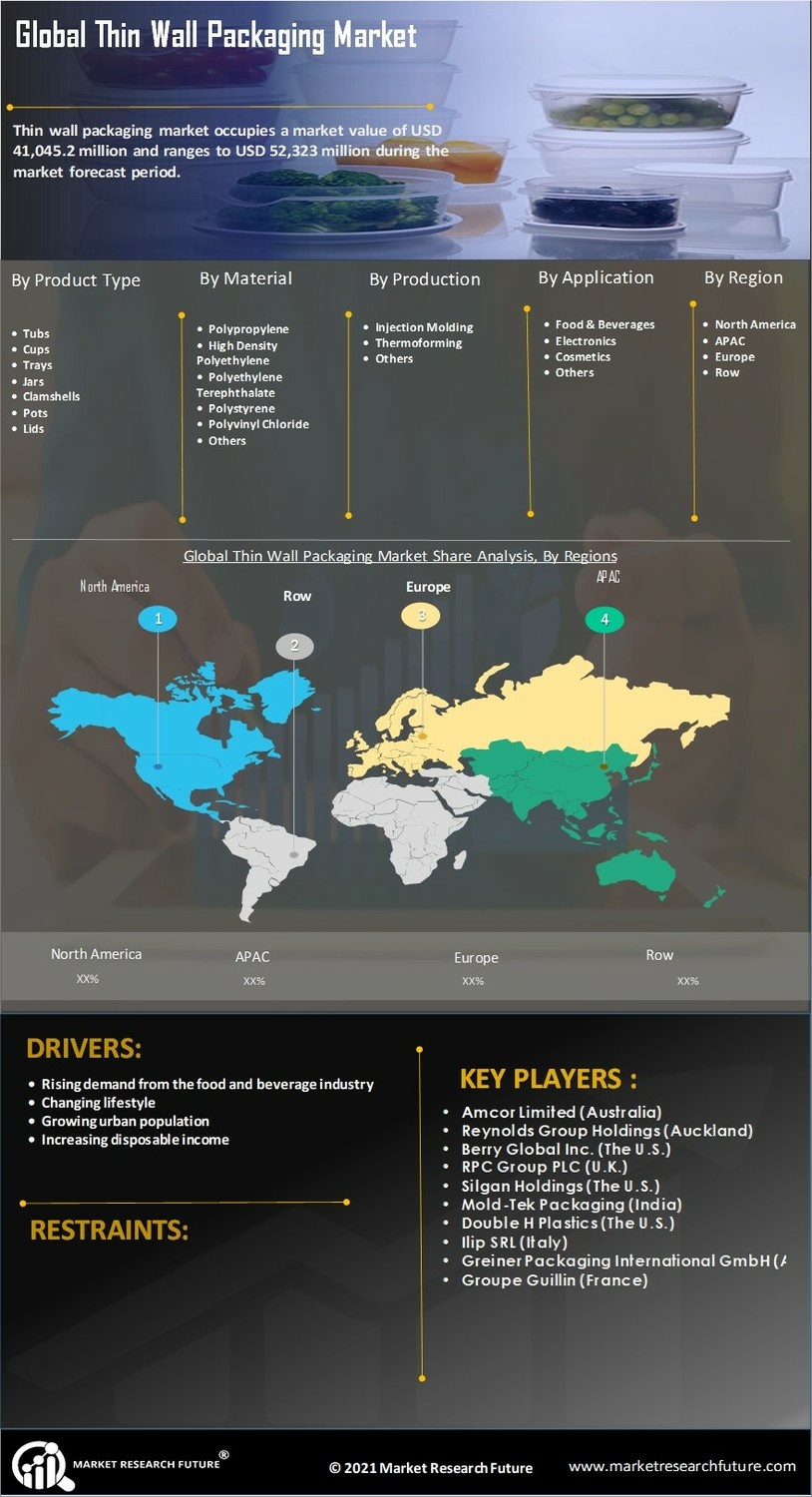

Technological advancements play a crucial role in shaping the Thin Wall Packaging Market. Innovations in manufacturing processes, such as injection molding and thermoforming, have led to the production of thinner, lighter, and more durable packaging solutions. These advancements not only reduce material costs but also enhance the efficiency of packaging operations. For instance, the introduction of smart packaging technologies, which incorporate sensors and QR codes, is gaining traction. These technologies provide real-time data on product freshness and enhance consumer engagement. The market is witnessing a shift towards automation and robotics in packaging lines, which further streamlines production. As a result, companies that leverage these technologies are likely to gain a competitive edge in the Thin Wall Packaging Market, driving growth and profitability.

Regulatory Compliance and Safety Standards

Regulatory compliance and safety standards are critical drivers for the Thin Wall Packaging Market. As food safety regulations become more stringent, manufacturers are required to ensure that their packaging meets specific safety criteria. Thin wall packaging, often designed to comply with these regulations, provides a reliable solution for various industries, particularly food and pharmaceuticals. The market is witnessing an increase in demand for packaging that not only meets safety standards but also enhances product protection. For instance, packaging that prevents contamination and preserves freshness is becoming essential. Furthermore, regulatory bodies are increasingly focusing on the environmental impact of packaging materials, prompting companies to adopt sustainable practices. This dual focus on safety and sustainability is likely to shape the future of the Thin Wall Packaging Market, as businesses strive to meet both consumer expectations and regulatory requirements.

Rising Demand from Food and Beverage Sector

The food and beverage sector is a significant driver for the Thin Wall Packaging Market. With the increasing demand for ready-to-eat meals and convenience foods, manufacturers are seeking efficient packaging solutions that preserve product quality while extending shelf life. Thin wall packaging offers an ideal solution, as it is lightweight and provides excellent barrier properties against moisture and oxygen. Market data indicates that the food packaging segment is expected to account for a substantial share of the overall thin wall packaging market, with projections suggesting a growth rate of around 4% annually. This trend is further fueled by the rise in online food delivery services, which necessitate packaging that is both functional and appealing. Consequently, the food and beverage industry's evolving needs are likely to propel the Thin Wall Packaging Market forward.

Consumer Preference for Lightweight Packaging

Consumer preference for lightweight packaging is increasingly influencing the Thin Wall Packaging Market. As consumers seek convenience and portability, packaging solutions that are easy to handle and transport are in high demand. Thin wall packaging, characterized by its reduced weight, not only meets these consumer expectations but also contributes to lower shipping costs for manufacturers. This aspect is particularly relevant in the context of e-commerce, where shipping efficiency is paramount. Market analysis suggests that lightweight packaging solutions can reduce transportation costs by up to 30%, making them an attractive option for businesses. Additionally, the aesthetic appeal of thin wall packaging, which often features sleek designs, resonates with modern consumers. Therefore, the growing preference for lightweight and visually appealing packaging is likely to drive the Thin Wall Packaging Market in the foreseeable future.