Regulatory Compliance and Standards

The stringent regulatory environment surrounding medical devices and packaging is a critical driver for the Thermoformed Medical Packaging Market. Compliance with regulations set forth by health authorities ensures that packaging materials are safe, effective, and suitable for medical applications. As regulations evolve, manufacturers are compelled to invest in high-quality materials and processes that meet these standards. The market data indicates that companies focusing on compliance are likely to gain a competitive edge, as adherence to regulations can enhance brand reputation and customer trust. This trend emphasizes the importance of quality assurance in the Thermoformed Medical Packaging Market, as it directly impacts product safety and efficacy.

Rising Demand for Sterile Packaging

The increasing emphasis on patient safety and infection control is driving the demand for sterile packaging solutions in the Thermoformed Medical Packaging Market. As healthcare providers prioritize the use of sterile products, the need for effective packaging that maintains sterility throughout the supply chain becomes paramount. This trend is reflected in the market data, which indicates that the sterile packaging segment is projected to grow at a compound annual growth rate of approximately 6% over the next few years. The Thermoformed Medical Packaging Market is adapting to these needs by developing innovative materials and designs that ensure the integrity of sterile products, thereby enhancing patient outcomes and reducing the risk of healthcare-associated infections.

Technological Innovations in Packaging

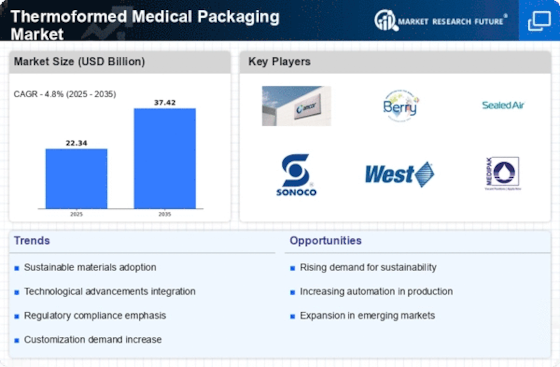

Technological advancements are reshaping the Thermoformed Medical Packaging Market, leading to the development of smarter and more efficient packaging solutions. Innovations such as smart packaging, which incorporates sensors to monitor conditions, are gaining traction. These technologies not only enhance the functionality of packaging but also improve supply chain management and inventory control. Market Research Future suggest that the integration of technology in packaging is expected to grow at a rate of 5% annually, as manufacturers seek to differentiate their products. This trend highlights the necessity for the Thermoformed Medical Packaging Market to embrace innovation to meet the evolving demands of healthcare providers and patients.

Growth in Minimally Invasive Procedures

The rise in minimally invasive surgical procedures is significantly influencing the Thermoformed Medical Packaging Market. These procedures often require specialized packaging solutions that can accommodate intricate medical devices and instruments. As the market for minimally invasive surgeries expands, driven by benefits such as reduced recovery times and lower risk of complications, the demand for tailored packaging solutions is expected to increase. Market analysis suggests that the segment related to packaging for minimally invasive devices is likely to witness a growth rate of around 7% annually. This trend underscores the necessity for the Thermoformed Medical Packaging Market to innovate and provide packaging that meets the specific requirements of these advanced medical technologies.

Sustainability and Eco-Friendly Practices

The increasing focus on sustainability is becoming a pivotal driver in the Thermoformed Medical Packaging Market. As environmental concerns rise, healthcare organizations are seeking eco-friendly packaging solutions that minimize waste and reduce carbon footprints. This shift is prompting manufacturers to explore biodegradable and recyclable materials, aligning with global sustainability goals. Market data indicates that the demand for sustainable packaging solutions is projected to grow by approximately 8% over the next few years. This trend not only reflects changing consumer preferences but also encourages the Thermoformed Medical Packaging Market to innovate in material science and design, ultimately contributing to a more sustainable healthcare ecosystem.