Thermal Ceramics Size

Thermal Ceramics Market Growth Projections and Opportunities

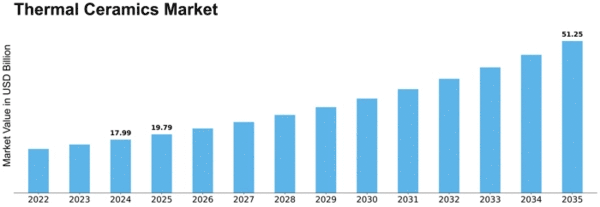

By the year 2027, it is predicted that the Thermal Ceramics Market will have surpassed a market value of USD 5.5 billion, exhibiting a Compound Annual Growth Rate (CAGR) of 4.7% throughout the course of the forecast period. The expansion of a number of different industries, including as the chemical, petrochemical, cement, energy and power, and iron and steel industries, is the primary driver of this growth. Furthermore, the projected demand for thermal ceramics is expected to be driven by our shift to energy efficient and environmentally friendly sustainable applications across various industries. Besides offering an almost flawless thermal performance, thermal ceramics also help in reducing the amount of heat loss, the conservation of energy, and the decrease in the overall operating costs. Ceramics that are thermally insulated can withstand the highest temperatures, that are due to the fact that they have been made for a particular purpose. They carry out numerous industrial jobs such as the lining of boilers, kilns, machines, and walls alongside others. Thermal ceramics which is found in so different types such as blanket, boards, belt, paper and so on is used in different processes and any place. Companies and users alike are by nature insensitive to temperature, which is one of the reasons that makes them the product of choice. The market for thermal ceramics exhibits year-on-year growth, due to the unique properties it holds. During the most recent years, thermal ceramics have also discovered applications in the construction and automotive industries. For instance, they play a significant part in the production of critical components for the automotive industry, such as noise reduction systems, thermal management systems, seats, eyewear, and a variety of other components. In addition, thermal ceramic construction materials are becoming increasingly popular due to the energy conservation features the materials possess. Over the course of the projection period, it is anticipated that the overall expansion of the thermal ceramics sector will be bolstered by the fact that countries are working toward the achievement of higher energy conservation objectives. These ceramics find widespread application in the manufacturing industries that deal with thermal processing operations.

Leave a Comment