Tethered Drones Market Summary

As per MRFR analysis, the Tethered Drones Market Size was estimated at 152.89 USD Million in 2024. The Tethered Drones industry is projected to grow from 162.22 USD Million in 2025 to 293.32 USD Million by 2035, exhibiting a compound annual growth rate (CAGR) of 6.1 during the forecast period 2025 - 2035.

Key Market Trends & Highlights

The Tethered Drones Market is poised for substantial growth driven by technological advancements and increasing demand for surveillance.

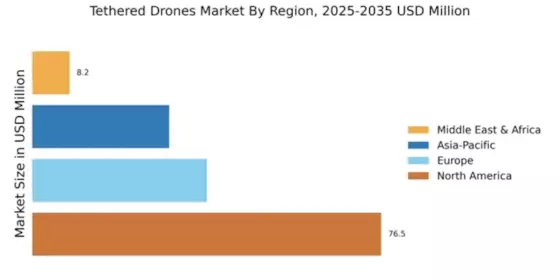

- North America remains the largest market for tethered drones, primarily due to its advanced technological infrastructure.

- The Asia-Pacific region is emerging as the fastest-growing market, fueled by rapid urbanization and increasing security concerns.

- The surveillance segment dominates the market, while the telecommunications segment is witnessing the fastest growth due to enhanced connectivity needs.

- Key market drivers include enhanced operational efficiency and a growing focus on security and surveillance, which are shaping industry dynamics.

Market Size & Forecast

| 2024 Market Size | 152.89 (USD Million) |

| 2035 Market Size | 293.32 (USD Million) |

| CAGR (2025 - 2035) | 6.1% |

Major Players

Aerialtronics (NL), Drone Aviation Holding Corp (US), Elistair (FR), Sky Sapience (IL), DroneShield (AU), AeroVironment (US), Quantum Systems (DE), Hoversurf (RU)