Top Industry Leaders in the System on Module Market

The Competitive Landscape of the System on Module Market

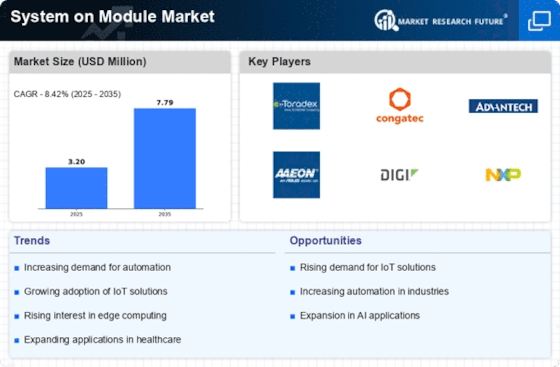

The System on Module (SOM) market is no longer a niche corner of embedded systems; it's a bustling crossroads where technology and applications collide. These compact boards, integrating key processing components like CPUs, GPUs, and memory onto a single unit, are powering a diverse range of products, from industrial robots to medical devices, and smart home gadgets. Understanding the competitive landscape, adopted strategies, key players, and emerging trends is crucial for thriving in this dynamic and complex arena.

Some of the System on Module companies listed below:

- AAEON Technology

- Advantech Co Ltd

- Avnet Inc

- Avalue Technology

- Axiomtek Co Ltd

- ConnectTech Inc

- Cognatec AG

- EMAC Inc

- Eurotech Inc

- Kontron ST&G

Strategies Adopted by Leaders:

- Embracing Open Standards and Interoperability: Adherence to open standards like SMARC, COM Express, or ETX ensures wider compatibility with existing hardware and software platforms, expanding potential customers and fostering market adoption.

- Prioritizing Long-Term Product Availability and Support: Maintaining long-term production of popular SOMs and providing extended support with software updates and bug fixes inspires confidence among customers with long-term project lifecycles.

- Investing in R&D and Pushing the Performance Envelope: Continuous innovation with next-generation processors, high-speed interfaces, and low-power architectures is crucial for maintaining market leadership and addressing the evolving needs of demanding applications.

- Partnerships and Ecosystem Building: Collaborating with other players in the technology ecosystem, such as software vendors, hardware manufacturers, and design houses, expands technical expertise, offers complete solutions, and strengthens brand presence.

- Focus on Security and Functional Safety: Addressing security vulnerabilities and adhering to stringent functional safety standards for devices deployed in critical applications like medical equipment or industrial automation can differentiate solutions and cater to specific regulatory requirements.

Factors for Market Share Analysis:

- Product Portfolio and Technological Breadth: The range and sophistication of SOMs offered, encompassing different processor architectures, performance levels, and peripheral options, significantly impact market reach. Offering customized solutions and tailoring features to specific applications can be significant differentiators.

- Target Market Focus: Catering to specific segments within the embedded systems ecosystem, like industrial automation, medical technology, or consumer electronics, requires tailored designs and partnerships. Addressing the unique needs of each segment can solidify market share within that niche.

- Software and Support Services: Robust software development kits (SDKs), drivers, and technical support are crucial for facilitating efficient development and integration of SOMs into specific applications. Offering comprehensive post-purchase support further enhances customer satisfaction and brand loyalty.

- Supply Chain Resilience and Quality Control: Ensuring reliable procurement of components and implementing stringent quality control measures are essential for mitigating supply chain disruptions and maintaining product reliability, impacting market reputation and long-term success.

- Pricing Strategy and Value Proposition: Striking the right balance between affordability and feature depth is essential. Offering flexible pricing models like tiered configurations, volume discounts, or service bundles can broaden appeal and increase market penetration.

New and Emerging Companies:

- Niche-Focused Startups: Companies like TechNexion and Phytec specialize in designing SOMs for specific applications like robotics, telecommunications, or aerospace, offering highly optimized solutions with superior performance or ruggedness for demanding environments.

- Software-Centric Players: Companies like Aaeon Technology and Avalue Technology focus on developing robust software platforms and development tools specifically designed for their SOMs, simplifying integration and reducing development time for customers.

- Open-Source Hardware Advocates: Companies like Librem and Boundary Devices champion open-source hardware principles, developing SOMs with readily available schematics and documentation, attracting developer communities and fostering innovation.

Latest Company Updates:

November 2023- The world’s leading System on Module (SOM) designer, developer, and manufacturer Variscite announced the upcoming launch of the i.MX 95 based system on a module (DART-MX95). The i.MX95 application processor family is based on the NXP i.MX 95 family of processors and is designed for high-end, scalable computing. This energy flex architecture includes several heterogeneous processing domains, including up to 6 cores (2.0 GHz at 2.0 GHz) in the i.MX95. Two independent real-time processors for safety /low power, as well as real-time use are also included. The CPU cores consist of 250 MHz ARM Cortex-M7, which is based on the Arm Cortex M7 family of processors, and the CPU cores are based on the ARM Cortex M33 family of processors. Dart-MX95 is designed for industrial, medical, and aviation applications, as well as robotics and vision-capable smart edge devices.

The platform offers a high-performance 2D / 3D graphics accelerator with Arm Mali power, high-quality multimedia, an integrated NPU (Network Processing Unit) accelerator and Internet Service Provider (ISP), high level of safety and security compliance (ASIL-B / SIL2 compliance), and a wide range of high-speed connections. Variscite is proud to announce the addition of the DART--MX95 to its DART pin2Pin family, which extends the scalability of this product family and guarantees future-proof applications for our customers. DART-MX 95 is part of the Variscite family of DART pin2 pins, which allows for the compatibility of modules based on Variscite's i.MX (MX 8M / 8M Plus / 8M Mini) pin2 pin family. This extends the lifespan of the pin2 pin family, reduces development time, reduces costs and risks, and allows for the scalability of additional modules.