Sunflower Oil Size

Market Size Snapshot

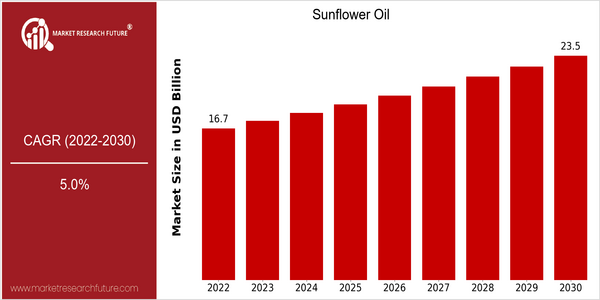

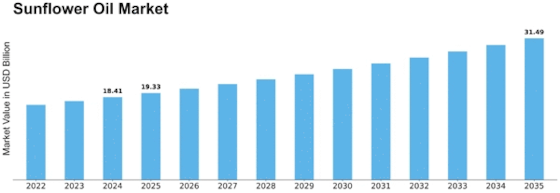

| Year | Value |

|---|---|

| 2022 | USD 16.7 Billion |

| 2030 | USD 23.5 Billion |

| CAGR (2022-2030) | 5.0 % |

Note – Market size depicts the revenue generated over the financial year

The market for sunflower oil is valued at about $ 16.7 billion in 2022, and is expected to reach $ 23.5 billion by 2030, growing at a CAGR of 5.0% during the forecast period. This growth indicates a strong demand for sunflower oil, driven by its increasing use in the food industry, particularly in cooking and food processing, as well as its growing popularity as a healthier alternative to other oils. The market is also fueled by a growing awareness of the health benefits associated with sunflower oil, such as its high content of unsaturated fatty acids and vitamin E, which is believed to be beneficial for the heart. Also, the advancement of agricultural practices and technology has increased the yield and quality of sunflower seeds. The improvement of extraction methods, such as cold pressing and refining, has also increased the efficiency and productivity of sunflower oil production. The main players in the market, such as Cargill, Archer Daniels Midland Company and Bunge Limited, are launching strategic initiatives, such as establishing long-term strategic alliances and investing in sustainable farming practices, to strengthen their positions in the market. In addition, the launch of products focusing on organic and non-GMO sunflower oil, which meet the changing preferences of consumers, is expected to boost market growth.

Regional Market Size

Regional Deep Dive

Sunflower oil is a global market, but the situation is very different in different regions. The agricultural practice of different regions, the taste of consumers and the legal environment of each region have a great influence on the market. In North America, the trend of health oil is the main impetus for the market; in Europe, the emphasis is on environment and organic products. In Asia-Pacific, the population and urbanization are the main driving forces, and the Middle East and Africa are facing the problem of disrupting the supply chain. Latin America is seeing an increase in its production capacity due to favorable weather conditions. The whole market is growing and shaped by the characteristics of the regions and the trends of the consumers.

Europe

- In Europe, the European Union's Green Deal is pushing for sustainable agricultural practices, leading to increased investments in organic sunflower oil production, with companies like Bunge and ADM actively participating in this transition.

- The rise of plant-based diets in Europe has significantly boosted the demand for sunflower oil as a preferred cooking oil, with innovative product launches focusing on health benefits and sustainability.

Asia Pacific

- The Asia-Pacific region is experiencing rapid urbanization and a growing middle class, which is driving the demand for sunflower oil, particularly in countries like India and China, where local producers are scaling up operations.

- Innovations in packaging and distribution, such as eco-friendly packaging solutions by companies like Marico, are enhancing market accessibility and appealing to environmentally conscious consumers.

Latin America

- Latin America is witnessing a significant increase in sunflower oil production, particularly in Argentina, where favorable climatic conditions and government support for agricultural exports are driving growth.

- The region is also seeing a rise in local brands focusing on health and wellness, with companies like Aceitera General Deheza promoting sunflower oil as a healthier alternative to other cooking oils.

North America

- North America is becoming more and more concerned about health. This has led to a growing demand for non-GMO and organic sunflower oil products. Companies like Spectrum Organic Products and Cargill have expanded their organic offerings.

- Recent regulatory changes in the U.S. have encouraged the labeling of oils, promoting transparency and consumer awareness, which is expected to enhance the market for high-quality sunflower oil.

Middle East And Africa

- In the Middle East and Africa, the market is influenced by fluctuating oil prices and supply chain challenges, with local governments, such as in Egypt, investing in agricultural reforms to boost sunflower cultivation.

- The introduction of initiatives like the African Union's Agenda 2063 aims to enhance food security, which is expected to positively impact sunflower oil production and consumption in the region.

Did You Know?

“Sunflower oil is one of the most widely used cooking oils globally, with its production accounting for approximately 10% of the total vegetable oil market.” — Food and Agriculture Organization (FAO)

Segmental Market Size

The sunflower oil market is growing steadily. The growing demand for healthier cooking oils and the rising demand for plant-based products are boosting the sunflower oil market. The high vitamin E and low saturated fat content of sunflower oil is a key driver of the market, as well as government regulations encouraging consumers to choose healthier food. The trend towards sustainable agriculture is boosting the appeal of sunflower oil, which is more sustainable than other cooking oils. The market for sunflower oil is in a mature stage, with the biggest producers being in Europe and North America. Leading companies are Cargill and Archer Daniels Midland. The main applications of sunflower oil are in cooking, food processing and cosmetics, demonstrating the versatility of the product. The shift to home cooking has been accelerated by the emergence of the november virus. Further developments in extraction and refining processes are shaping the market, improving the quality and efficiency of production.

Future Outlook

From 2022 to 2030, the sunflower oil market is expected to increase from $16.7 billion to $23. 5 billion, with a compound annual growth rate of 5. 0 %. The main reason for this is that consumers are increasingly choosing healthier cooking oils, and sunflower oil is expected to penetrate further into developed and developing countries, and the consumption rate will increase by about 15% by 2030. The main reason for this is that consumers are increasingly aware of the health benefits of sunflower oil, such as the high content of unsaturated fatty acids and vitamin E. Also, the yield and extraction efficiency of sunflower seeds and sunflower oil are expected to improve with the development of science and technology. The production of sunflower seeds and sunflower oil will increase, and the government will support the development of sunflower seeds and sunflower oil. Besides, the demand for organic and non-GMO sunflower oil will increase, which will also meet the health needs of consumers, and the product line will also be diversified. The trend of the food industry in the world is changing, and sunflower oil will be able to meet the demand for healthy cooking oils.

Leave a Comment