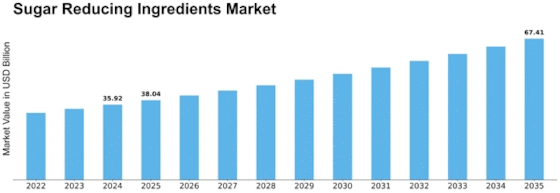

Sugar Reducing Ingredients Size

Sugar Reducing Ingredients Market Growth Projections and Opportunities

The Sugar Reducing Ingredients market is intricately linked to several factors that collectively influence its dynamics and growth trajectory. One of the primary drivers steering this market is the increasing global concern about rising obesity rates and related health issues. As consumers become more health-conscious, there is a growing demand for products with reduced sugar content. Sugar reducing ingredients, including artificial sweeteners, natural sweeteners, and sugar substitutes, have gained prominence as viable alternatives to traditional sugars. The desire for healthier lifestyles and a focus on weight management contribute significantly to the adoption of these ingredients in various food and beverage products.

The global trend towards clean-label and natural products is another key factor shaping the Sugar Reducing Ingredients market. Consumers are increasingly seeking food and beverage options with transparent and recognizable ingredients. This preference aligns with the market's response to incorporate natural sugar alternatives, such as stevia, monk fruit, and erythritol, into various products. Manufacturers are capitalizing on this trend by formulating reduced-sugar options that appeal to health-conscious consumers looking for alternatives without sacrificing taste.

Government regulations and initiatives aimed at reducing sugar consumption are pivotal market factors. Various countries have implemented or proposed regulations to curb excessive sugar intake, including sugar taxes and mandatory labeling of added sugars. These regulatory measures have prompted the food and beverage industry to explore and adopt sugar reducing ingredients as part of their strategies to comply with these regulations and cater to a health-aware consumer base.

Changing consumer preferences and awareness of the potential health risks associated with high sugar consumption contribute to the growth of the Sugar Reducing Ingredients market. Consumers are actively seeking products that help manage blood sugar levels, reduce calorie intake, and prevent dental issues linked to excessive sugar consumption. This awareness has led to an increased demand for products formulated with sugar reducing ingredients, fostering innovation in the development of new and improved formulations.

Technological advancements play a crucial role in the Sugar Reducing Ingredients market. Ongoing research and development efforts focus on enhancing the taste, texture, and stability of sugar substitutes. Advances in ingredient formulation and production methods enable manufacturers to create sugar-reduced products that closely mimic the sensory experience of traditional sugary counterparts. This innovation is vital for broadening consumer acceptance and expanding the market for sugar reducing ingredients.

The influence of the food and beverage industry's commitment to corporate social responsibility and sustainability is evident in the Sugar Reducing Ingredients market. Manufacturers are increasingly emphasizing environmentally friendly sourcing practices for sugar alternatives, contributing to the overall sustainability of their products. This focus on sustainability aligns with the values of environmentally conscious consumers, influencing their purchasing decisions and fostering brand loyalty.

The impact of economic factors, such as fluctuations in raw material prices, is another dimension of the Sugar Reducing Ingredients market. The cost and availability of sugar substitutes and alternative sweeteners can be influenced by factors like the production and supply of raw materials. Market players must navigate these economic considerations to maintain competitive pricing and ensure the stability of their supply chains.

Leave a Comment