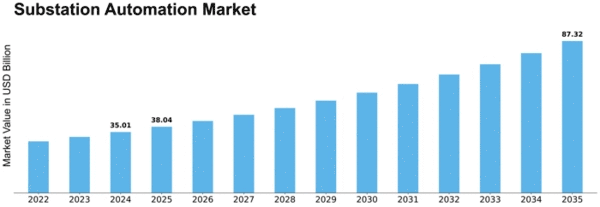

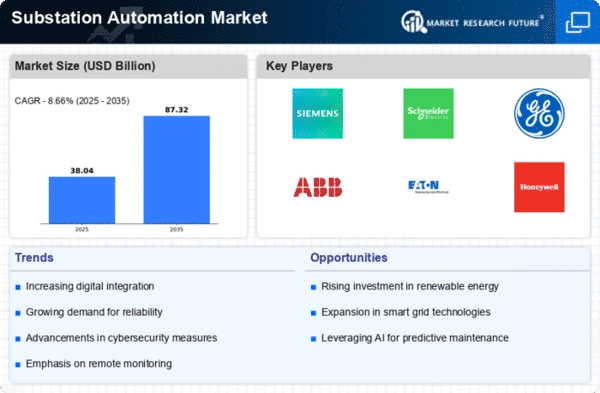

Substation Automation Size

Substation Automation Market Growth Projections and Opportunities

The Substation Automation Market is influenced by a myriad of market factors that shape its growth and dynamics. One key determinant is the increasing demand for reliable and efficient power supply systems. As industries and communities continue to expand, the need for a robust electrical infrastructure becomes paramount. Substation automation, with its ability to enhance grid reliability, reduce downtime, and optimize energy distribution, aligns perfectly with the rising demand for seamless power delivery.

Technological advancements play a pivotal role in steering the Substation Automation Market. The integration of smart technologies, such as sensors, communication networks, and intelligent electronic devices, empowers substations to operate with greater autonomy and efficiency. The advent of the Internet of Things (IoT) and Industry 4.0 has further propelled the market forward, allowing for real-time monitoring, diagnostics, and control of substations. These technological innovations not only enhance operational efficiency but also contribute to minimizing maintenance costs, driving the market's growth.

Moreover, the global push towards sustainable and renewable energy sources significantly influences the Substation Automation Market. As the world increasingly shifts towards cleaner energy solutions, the integration of renewable sources like solar and wind into the power grid necessitates advanced automation in substations. The ability of substation automation systems to adapt to diverse energy sources and manage fluctuations in power generation positions them as crucial components in the transition to a greener energy landscape.

Government initiatives and regulations also act as catalysts for the Substation Automation Market. Authorities worldwide are emphasizing the modernization of existing power infrastructure to enhance grid reliability, reduce transmission losses, and promote energy efficiency. Incentive programs and regulatory frameworks that encourage the adoption of substation automation solutions further stimulate market growth. Compliance with these regulations not only ensures a resilient power grid but also addresses environmental concerns associated with traditional power distribution methods.

The increasing complexity of power grids due to growing urbanization and industrialization is another significant factor shaping the Substation Automation Market. As urban areas expand and industrial facilities multiply, power grids become more intricate, requiring sophisticated automation solutions for effective management. Substation automation not only aids in streamlining grid operations but also facilitates the integration of distributed energy resources, microgrids, and electric vehicles, thereby accommodating the evolving landscape of power consumption.

Leave a Comment