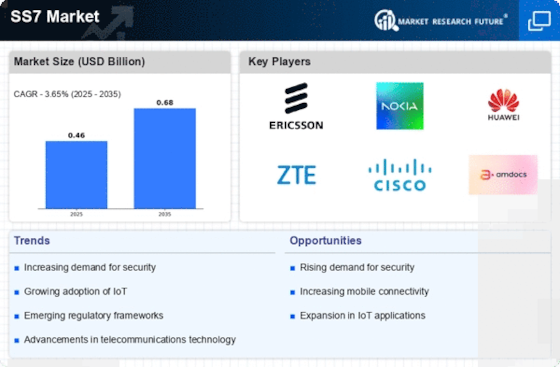

Leading market players are investing heavily in research and development to expand their product lines, which will help the SS7 Market grow even more. Market participants are also undertaking various strategic activities to expand their global footprint, with important market developments including new product launches, contracts & agreements, mergers and acquisitions, major investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, the SS7 industry must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the global SS7 industry to benefit clients and increase the market sector. In recent years, the SS7 industry has offered some of the most significant advantages to medicine. Major players in the SS7 Market, including Oracle Corporation (US), Mitel Networks Corporation (Canada), Tieto (Finland), Net Number Inc. (Netherlands), Ribbon Communications (US), Ericsson AB (Sweden), Dialogic Corporation (US), Huawei Technologies Co.

Ltd (China), TNS Inc. (US), PCCW Global (Hong Kong), and others, are attempting to increase market demand by investing in research and development operations.

Douglas Ranalli's, NetNumber, Inc., founded in 1998, located in Lowell, Massachusetts, United States, is a company that provides centralized signaling and routing controller solutions. It is established to empower every telecom operator and enterprise with powerful phone numbers to streamline their operations, reduce costs and check frauds worldwide. It is a secure digital world where communication service providers and enterprises can operate worldwide to transform all mobile generations in new ways. It is an innovation management industry. It offers individual solutions like authentication, interworking, and global data.

It uses 26 technology products and services, which include HTML 5, Google Analytics, etc.

In August NetNumber, Inc. launched its Guaranteed CallerTM family of standards-compliant STIR/SHAKEN solutions, extending guaranteed caller service providers to support TDM/SS7 Market networks.

Larry Elison, Bob Miner, and Ed Oates's Oracle Corporation, founded in 1977 in Austin, Texas, United States, is an American international computer technology corporation. It is the third largest software company in the world which sells database software and technology, enterprise resource planning, customer relationship management, signaling routers, enterprise manager, middleware, fusion, workstations, servers, supply chain management software, etc.

In March Oracle announced that it had agreed to acquire LiveData Utilities.