Top Industry Leaders in the Sports drink Market

Strategies Adopted by Sports Drink Key Players

The Sports Drink market, a significant segment within the global beverage industry, is influenced by various factors such as the rising health and fitness trends, increased consumer awareness of hydration needs, and the growing participation in sports and fitness activities. As of 2023, key players strategically position themselves in this competitive landscape, implementing various strategies to maintain or enhance their market share.

Key players in the Sports Drink market deploy a range of strategies to remain competitive. Continuous investment in marketing and advertising is a central strategy, emphasizing the functional benefits of sports drinks, including hydration, electrolyte replenishment, and energy support. Strategic partnerships with sports teams, events, and fitness influencers contribute to expanding market reach and brand visibility. Product innovation is another focus, with companies introducing new flavors, formulations, and packaging to cater to evolving consumer preferences.

Market Share Analysis:Market share analysis in the Sports Drink market is influenced by several factors, including brand recognition, product quality, pricing strategies, and distribution efficiency. Companies with strong brand equity and positive consumer perceptions tend to secure a larger market share. Pricing strategies that balance affordability with perceived value play a crucial role, especially considering the price sensitivity of consumers in this market. Effective distribution networks, covering both traditional retail channels and emerging e-commerce platforms, are vital for maintaining a competitive edge.

New and Emerging Companies:While key players dominate the Sports Drink market, new and emerging companies are entering the sector, often focusing on specific niche markets or introducing innovative sports drink formulations. These entrants may emphasize natural and organic ingredients, reduced sugar content, or unique functional benefits to differentiate themselves. Although their market share may be relatively modest compared to industry leaders, these companies contribute to the overall diversification and innovation in the Sports Drink market.

Industry Trends:The Sports Drink market has witnessed noteworthy industry news and investment trends in 2023. Key players are investing in sustainable packaging solutions, emphasizing environmental responsibility in response to growing consumer demand for eco-friendly products. Collaborations with fitness apps and wearables are driving the development of smart sports drinks, incorporating personalized hydration recommendations. Additionally, investments in research and development focus on addressing emerging health trends, such as the inclusion of functional ingredients like adaptogens and antioxidants.

Competitive Scenario:The Sports Drink market is marked by intense rivalry among key players striving to capture a larger share of the growing market. The industry's competitiveness is evident in the emphasis on innovation, marketing, and strategic partnerships to address evolving consumer preferences. The global reach of these companies allows them to adapt to regional tastes, capitalize on emerging markets, and navigate regulatory landscapes, contributing to the overall dynamism of the industry.

Recent Development in 2023:Coca-Cola: Highlighted the need of particular electrolytes for hydration and performance with the introduction of the Powerade ION4 Advanced Electrolyte System.PepsiCo: To meet consumer demand for clean-label products and provide electrolytes without artificial sweeteners, the company introduced Gatorade Zero Sugar with Natural Flavours.

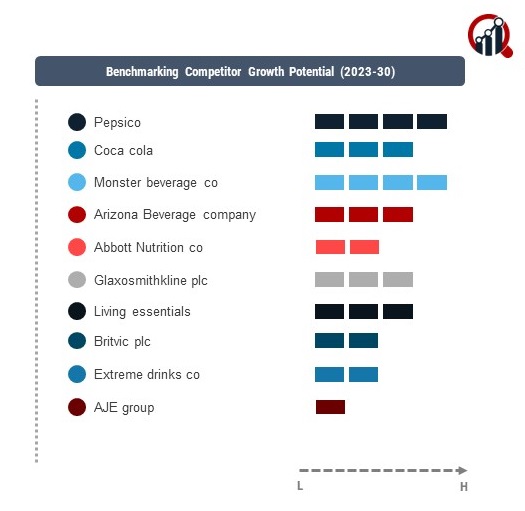

Key Players:PepsicoCoca colaMonster beverage coArizona Beverage companyAbbott Nutrition coGlaxosmithkline plcLiving essentialsBritvic plcExtreme drinks coAJE groupArctico beverage company international incD'angeloChampion nutrition incFraser and neave holdings.