Diverse Flavor Profiles

The Specialty Snacks Market is characterized by an expanding array of flavor profiles that cater to diverse consumer preferences. As globalization continues to influence culinary trends, consumers are increasingly seeking unique and exotic flavors in their snack choices. This demand for variety has led to the introduction of snacks infused with international spices, herbs, and ingredients. For instance, snacks featuring flavors inspired by Asian, Mediterranean, and Latin American cuisines are gaining traction. This trend not only enhances consumer experience but also encourages brands to innovate and differentiate their products in a competitive market. The Specialty Snacks Market is thus witnessing a dynamic shift towards more adventurous flavor offerings.

Health and Wellness Trends

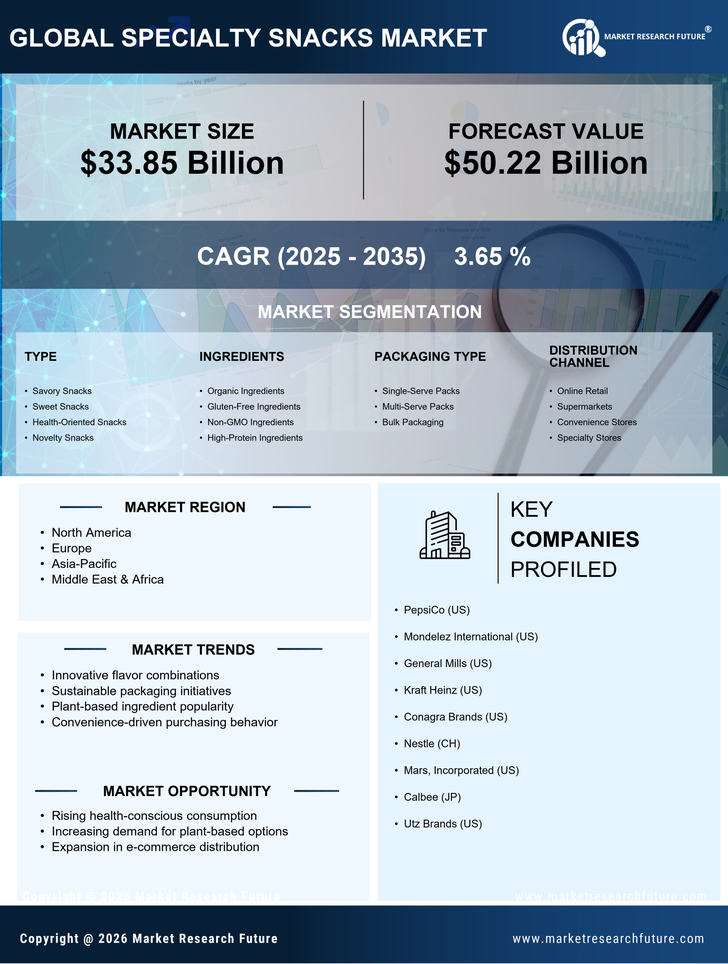

The Specialty Snacks Market is increasingly influenced by the rising health and wellness trends among consumers. As individuals become more health-conscious, there is a growing demand for snacks that are not only tasty but also nutritious. This shift is reflected in the increasing popularity of snacks that are low in sugar, high in protein, and rich in natural ingredients. According to recent data, the market for healthy snacks is projected to grow at a compound annual growth rate of approximately 8% over the next five years. This trend indicates that consumers are willing to pay a premium for specialty snacks that align with their health goals, thereby driving innovation and product development within the Specialty Snacks Market.

Sustainability and Ethical Sourcing

Sustainability has emerged as a pivotal driver within the Specialty Snacks Market, as consumers become more aware of environmental issues and ethical sourcing practices. Brands that prioritize sustainable ingredients and eco-friendly packaging are likely to resonate with a growing segment of environmentally conscious consumers. Recent studies indicate that nearly 60% of consumers are willing to change their purchasing habits to reduce environmental impact. This shift is prompting companies to adopt sustainable practices, such as sourcing ingredients from local farms and utilizing biodegradable packaging. As a result, the Specialty Snacks Market is evolving to meet the demands of consumers who value sustainability, thereby influencing purchasing decisions and brand loyalty.

Convenience and On-the-Go Consumption

The fast-paced lifestyle of modern consumers is significantly impacting the Specialty Snacks Market, as convenience becomes a key factor in purchasing decisions. With an increasing number of individuals seeking quick and easy snack options, products that are portable and ready-to-eat are gaining popularity. This trend is particularly evident among busy professionals and students who prefer snacks that can be consumed on-the-go. Data suggests that the demand for single-serve packaging is on the rise, as it aligns with the need for convenience. Consequently, brands are innovating their product lines to include more portable options, thereby enhancing their appeal within the Specialty Snacks Market.

Digital Marketing and Social Media Influence

The rise of digital marketing and social media platforms is reshaping the landscape of the Specialty Snacks Market. Brands are increasingly leveraging social media to engage with consumers, promote new products, and build brand loyalty. Influencer marketing, in particular, has proven effective in reaching target demographics, as consumers often trust recommendations from social media personalities. This trend is supported by data indicating that over 70% of consumers are influenced by social media when making food-related purchasing decisions. As a result, companies are investing in digital marketing strategies to enhance their visibility and connect with consumers, thereby driving growth within the Specialty Snacks Market.