Government Initiatives and Funding

Government initiatives and funding significantly impact the medical imaging-software market in Spain. The Spanish government has recognized the importance of advanced medical technologies and is investing in healthcare infrastructure. Recent reports indicate that public funding for healthcare technology has increased by 15% in the last year, aimed at improving diagnostic capabilities. This financial support encourages the adoption of innovative imaging software solutions among healthcare providers. Additionally, government policies promoting research and development in medical technology further stimulate market growth. As a result, the medical imaging-software market is likely to benefit from enhanced access to cutting-edge technologies, ultimately improving patient care and outcomes.

Rising Demand for Diagnostic Imaging

The medical imaging-software market in Spain experiences a notable increase in demand for diagnostic imaging solutions. This trend is driven by the growing prevalence of chronic diseases and an aging population, which necessitates advanced imaging technologies for accurate diagnosis. According to recent data, the demand for imaging services is projected to grow at a CAGR of 7.5% over the next five years. As healthcare providers seek to enhance patient outcomes, the integration of sophisticated imaging software becomes essential. This rising demand not only boosts the market but also encourages software developers to innovate and improve their offerings, thereby enhancing the overall quality of healthcare services in Spain.

Growing Focus on Personalized Medicine

The medical imaging-software market in Spain is increasingly influenced by the growing focus on personalized medicine. As healthcare shifts towards tailored treatment plans, the demand for imaging software that can provide detailed insights into individual patient conditions rises. This trend is supported by advancements in genomics and data analytics, which allow for more precise imaging techniques. The market is expected to grow as healthcare providers seek software solutions that facilitate personalized diagnostics and treatment strategies. This shift not only enhances patient satisfaction but also improves clinical outcomes, indicating a promising future for the medical imaging-software market in Spain.

Technological Advancements in Imaging Software

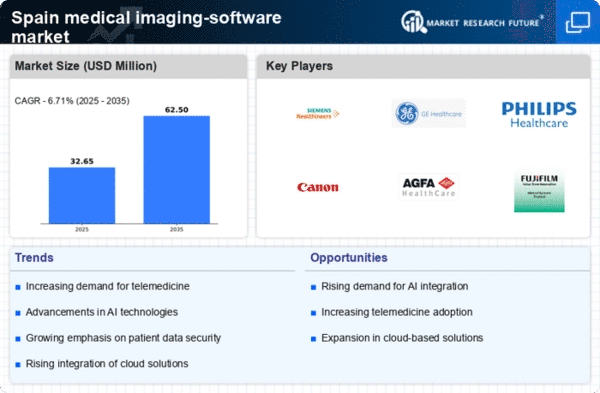

Technological advancements play a crucial role in shaping the medical imaging-software market in Spain. Innovations such as 3D imaging, enhanced visualization techniques, and improved data analytics capabilities are transforming the landscape of medical imaging. These advancements enable healthcare professionals to make more informed decisions, leading to better patient care. The market is witnessing a shift towards cloud-based solutions, which offer scalability and flexibility. Furthermore, the integration of machine learning algorithms into imaging software is expected to enhance diagnostic accuracy. As a result, the medical imaging-software market is likely to expand, with an anticipated growth rate of 6.8% annually, reflecting the increasing reliance on technology in healthcare.

Increased Collaboration Between Healthcare Providers

Increased collaboration between healthcare providers is emerging as a key driver for the medical imaging-software market in Spain. As hospitals and clinics work together to share resources and expertise, the demand for integrated imaging solutions rises. Collaborative networks enable healthcare facilities to access advanced imaging technologies, improving diagnostic capabilities across the board. This trend is further supported by the establishment of regional health alliances, which aim to enhance healthcare delivery. The medical imaging-software market is likely to benefit from this collaborative approach, as it fosters innovation and encourages the development of comprehensive imaging solutions that meet the diverse needs of patients.