Growing Awareness and Education

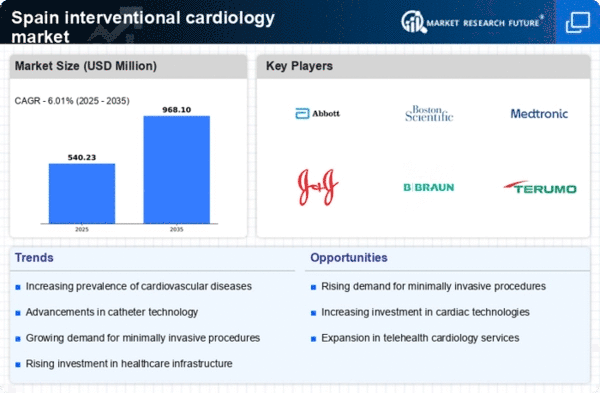

There is a notable increase in public awareness regarding cardiovascular health in Spain, which serves as a significant driver for the interventional cardiology market. Educational campaigns and initiatives by health organizations have led to a better understanding of heart diseases and the importance of early intervention. As individuals become more informed about the risks associated with cardiovascular conditions, they are more likely to seek medical advice and treatment. This shift in patient behavior is expected to boost the demand for interventional cardiology procedures, contributing to an estimated market growth of 6% over the next few years.

Supportive Regulatory Environment

The regulatory landscape in Spain is becoming increasingly supportive of advancements in the interventional cardiology market. Regulatory bodies are streamlining the approval processes for new medical devices and procedures, which encourages innovation and market entry. This supportive environment is crucial for manufacturers and healthcare providers, as it facilitates quicker access to cutting-edge technologies. As a result, the interventional cardiology market is likely to benefit from a more dynamic and competitive landscape, with an anticipated growth rate of approximately 5% over the next few years, as new products and services are introduced.

Investment in Healthcare Infrastructure

Spain's commitment to enhancing its healthcare infrastructure significantly impacts the interventional cardiology market. The government has allocated substantial funding to modernize hospitals and clinics, ensuring they are equipped with the latest medical technologies. This investment is crucial, as it facilitates the adoption of advanced interventional cardiology techniques and devices. Reports indicate that healthcare spending in Spain is expected to reach €200 billion by 2026, with a notable portion directed towards cardiology services. Consequently, this influx of resources is likely to enhance the capabilities of healthcare providers, thereby driving the growth of the interventional cardiology market.

Rising Prevalence of Cardiovascular Diseases

The increasing incidence of cardiovascular diseases in Spain is a primary driver for the interventional cardiology market. According to recent health statistics, cardiovascular diseases account for approximately 30% of all deaths in the country. This alarming trend necessitates advanced interventional procedures, such as angioplasty and stenting, to manage and treat these conditions effectively. The demand for innovative treatment options is expected to rise, leading to a projected market growth of around 5% annually. As healthcare providers seek to improve patient outcomes, investments in interventional cardiology technologies are likely to increase, further propelling the market forward.

Technological Innovations in Medical Devices

The interventional cardiology market is experiencing a surge in technological innovations, which are transforming treatment methodologies. The introduction of minimally invasive techniques and advanced imaging technologies has improved procedural outcomes and reduced recovery times for patients. In Spain, the market for interventional cardiology devices is projected to grow by 7% annually, driven by the development of next-generation stents and catheter systems. These innovations not only enhance the effectiveness of treatments but also expand the range of procedures available, thereby attracting more patients to seek interventional cardiology services.