Patient-Centric Care Models

The shift towards patient-centric care models is reshaping the hospital services market in Spain. Hospitals are increasingly focusing on personalized treatment plans that cater to individual patient needs, preferences, and values. This approach not only enhances patient satisfaction but also improves health outcomes, as patients are more likely to engage in their care. In 2025, it is anticipated that hospitals adopting these models will see a 20% increase in patient retention rates. Furthermore, the emphasis on shared decision-making and holistic care is likely to foster stronger patient-provider relationships, which can lead to better adherence to treatment protocols. As the hospital services market continues to evolve, the integration of patient feedback into service delivery will become paramount, driving further innovation and improvement in healthcare practices.

Government Healthcare Initiatives

Government initiatives play a crucial role in shaping the hospital services market in Spain. The Spanish government has been actively investing in healthcare infrastructure, aiming to enhance service delivery and accessibility. In recent years, funding for public hospitals has increased, with a reported budget allocation of €10 billion for healthcare improvements in 2025. These initiatives are designed to reduce waiting times and improve the quality of care, which is essential for maintaining public trust in the healthcare system. Additionally, policies promoting preventive care and early intervention are likely to drive demand for hospital services, as they encourage patients to seek medical attention before conditions worsen. This proactive approach may lead to a more sustainable hospital services market, as it focuses on long-term health outcomes.

Rising Chronic Disease Prevalence

The prevalence of chronic diseases in Spain is a significant driver of the hospital services market. Conditions such as diabetes, cardiovascular diseases, and respiratory disorders are on the rise, necessitating increased hospital visits and long-term care. As of 2025, it is estimated that nearly 30% of the Spanish population suffers from at least one chronic condition, which places a substantial burden on healthcare resources. This trend is likely to result in higher demand for specialized hospital services, including outpatient care and rehabilitation programs. Hospitals are thus compelled to adapt their services to cater to this growing demographic, potentially leading to an expansion of facilities and services tailored to chronic disease management. The hospital services market must evolve to meet these challenges, ensuring that adequate resources are allocated to manage the increasing patient load.

Increased Health Awareness and Education

There is a growing trend of health awareness and education among the Spanish population, which is significantly influencing the hospital services market. As individuals become more informed about health issues and preventive measures, they are more likely to seek medical advice and services. This heightened awareness is expected to lead to an increase in hospital visits, particularly for preventive screenings and early diagnosis. In 2025, it is projected that the demand for preventive services will rise by 25%, prompting hospitals to expand their offerings in this area. Additionally, educational campaigns aimed at promoting healthy lifestyles are likely to reduce the incidence of preventable diseases, thereby impacting the overall demand for hospital services. This trend suggests a shift towards a more proactive healthcare system, where prevention is prioritized alongside treatment.

Technological Advancements in Healthcare

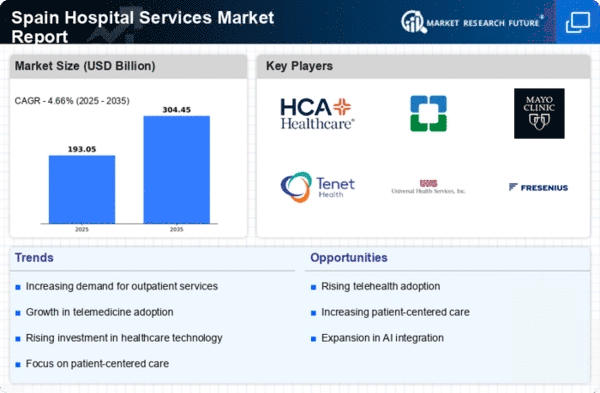

The hospital services market in Spain is experiencing a notable transformation due to rapid technological advancements. Innovations such as telemedicine, electronic health records, and AI-driven diagnostics are enhancing patient care and operational efficiency. In 2025, the integration of these technologies is projected to increase the market's value by approximately 15%. Hospitals are investing heavily in digital infrastructure, which not only improves patient outcomes but also streamlines administrative processes. This shift towards technology is likely to attract more patients seeking modern healthcare solutions, thereby expanding the hospital services market. Furthermore, the adoption of advanced medical equipment is expected to reduce treatment times and improve accuracy in diagnoses, which could lead to higher patient satisfaction and retention rates.