Rising Disposable Income

An increase in disposable income among the Spanish population is likely to positively impact the facial injectors market. As individuals have more financial resources, they are more willing to invest in aesthetic treatments. This trend is particularly evident among middle to upper-income groups, who prioritize personal grooming and appearance. In 2025, it is estimated that the average disposable income in Spain will rise by 5%, allowing more consumers to consider facial injectors as a viable option. The facial injectors market is thus poised to benefit from this economic shift, as more individuals seek to enhance their appearance through non-invasive procedures.

Influence of Social Media

Social media platforms play a pivotal role in shaping perceptions of beauty and influencing consumer behavior in Spain. The facial injectors market benefits from the visibility and promotion of aesthetic treatments through influencers and beauty enthusiasts. As individuals share their experiences and results online, potential customers are increasingly motivated to explore similar options. This trend has led to a notable increase in inquiries and bookings for facial injectors, with a reported rise of 30% in consultations in 2025. The impact of social media on beauty standards continues to drive the growth of the facial injectors market.

Expansion of Aesthetic Clinics

The proliferation of aesthetic clinics across Spain is a significant factor contributing to the growth of the facial injectors market. With more clinics offering specialized services, consumers have greater access to treatments. This expansion is not only limited to urban areas but is also reaching suburban regions, thereby broadening the customer base. In 2025, the number of aesthetic clinics is expected to increase by 15%, enhancing competition and driving innovation within the facial injectors market. As clinics strive to differentiate themselves, they are likely to adopt advanced technologies and offer personalized services, further stimulating market growth.

Growing Aesthetic Consciousness

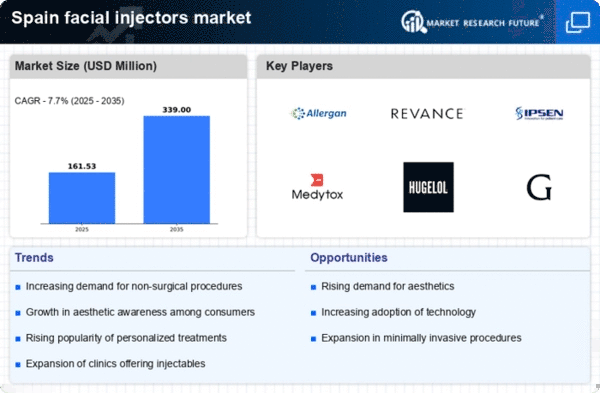

The increasing societal emphasis on aesthetics is a notable driver for the facial injectors market in Spain. As individuals become more aware of their appearance, the demand for cosmetic enhancements rises. This trend is particularly pronounced among younger demographics, who are more inclined to seek non-invasive procedures. In 2025, the market is projected to grow at a CAGR of approximately 8.5%, reflecting a shift in consumer attitudes towards beauty and self-care. The facial injectors market is thus experiencing a surge in interest, with consumers actively seeking solutions that enhance their facial features without the need for surgical interventions.

Advancements in Product Formulations

Innovations in product formulations for facial injectors are driving the evolution of the market in Spain. Manufacturers are continuously developing new products that offer improved results, longer-lasting effects, and reduced side effects. These advancements are crucial in attracting consumers who may have previously been hesitant to undergo such treatments. In 2025, the introduction of new hyaluronic acid-based injectors is expected to capture a significant share of the market, appealing to a broader audience. The facial injectors market is thus witnessing a transformation, as enhanced formulations contribute to increased consumer confidence and satisfaction.