Rising Aging Population

The demographic shift towards an aging population in Spain is a crucial driver for the diagnostic imaging services market. As individuals age, the prevalence of chronic diseases and conditions requiring diagnostic imaging increases. According to recent statistics, approximately 19% of the Spanish population is aged 65 and older, a figure projected to rise significantly in the coming years. This demographic trend necessitates enhanced imaging services to facilitate early diagnosis and effective treatment. Consequently, healthcare providers are likely to invest in advanced imaging technologies to cater to the growing demand. The aging population's healthcare needs may lead to an expansion of facilities offering diagnostic imaging services, thereby stimulating market growth.

Increased Health Awareness

There appears to be a growing awareness among the Spanish population regarding health and wellness, which is positively influencing the diagnostic imaging-services market. Individuals are increasingly seeking preventive care and early diagnosis, leading to a higher utilization of imaging services. Surveys indicate that around 70% of Spaniards prioritize regular health check-ups, which often include imaging tests. This trend is likely to drive demand for various imaging modalities, such as MRI and CT scans, as patients become more proactive in managing their health. Consequently, healthcare providers may expand their imaging capabilities to meet this rising demand, thereby fostering market growth.

Rising Incidence of Chronic Diseases

The increasing prevalence of chronic diseases in Spain drives the diagnostic imaging services market. Conditions such as cardiovascular diseases, diabetes, and cancer are becoming more common, necessitating advanced diagnostic imaging for effective management. Recent health reports indicate that nearly 25% of the Spanish population suffers from chronic illnesses, which often require regular imaging for monitoring and treatment. This trend is likely to lead to a higher demand for imaging services, as healthcare providers seek to offer comprehensive care for patients with chronic conditions. Consequently, the diagnostic imaging-services market may expand to accommodate the growing need for diagnostic procedures.

Technological Integration in Healthcare

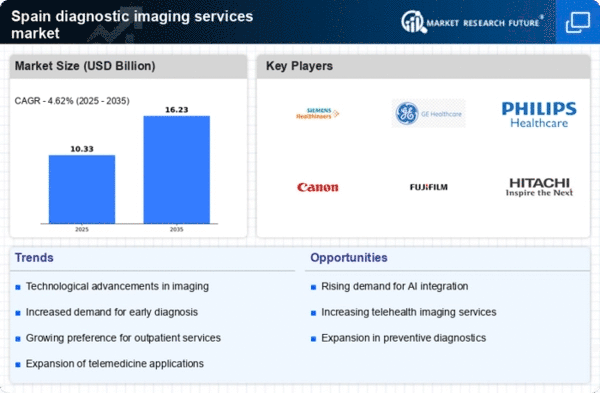

The integration of advanced technologies into healthcare systems in Spain drives the diagnostic imaging services market. Innovations such as artificial intelligence (AI) and machine learning are enhancing the accuracy and efficiency of imaging procedures. For instance, AI algorithms can assist radiologists in interpreting images more effectively, potentially reducing diagnostic errors. The Spanish government has been promoting the adoption of digital health technologies, which may further accelerate the integration of sophisticated imaging solutions. As hospitals and clinics increasingly adopt these technologies, the demand for diagnostic imaging services is expected to rise, reflecting a shift towards more precise and timely healthcare delivery.

Government Investment in Healthcare Infrastructure

Government initiatives aimed at enhancing healthcare infrastructure in Spain are likely to bolster the diagnostic imaging-services market. Recent budgets indicate a commitment to increasing healthcare spending, with a focus on modernizing facilities and expanding access to advanced diagnostic tools. The Spanish government has allocated approximately €1 billion for healthcare improvements, which may include investments in imaging technologies. This financial support could facilitate the establishment of new imaging centers and the upgrading of existing equipment, ultimately improving service delivery. As a result, the diagnostic imaging-services market may experience significant growth driven by enhanced infrastructure and accessibility.