Spain Dental Software Market Summary

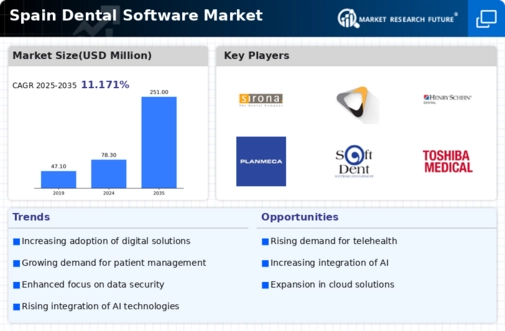

The Spain Dental Software Market is projected to grow significantly from 78.3 USD Million in 2024 to 251 USD Million by 2035.

Key Market Trends & Highlights

Spain Dental Software Market Key Trends and Highlights

- The market is expected to experience a compound annual growth rate (CAGR) of 11.17% from 2025 to 2035.

- By 2035, the market valuation is anticipated to reach 251 USD Million, indicating robust growth potential.

- In 2024, the market is valued at 78.3 USD Million, reflecting the current demand for dental software solutions in Spain.

- Growing adoption of digital technologies due to increasing patient expectations is a major market driver.

Market Size & Forecast

| 2024 Market Size | 78.3 (USD Million) |

| 2035 Market Size | 251 (USD Million) |

| CAGR (2025-2035) | 11.17% |

Major Players

3Shape, Sirona Dental Systems, Carestream Dental, Xylos, Implant Innovations, Henry Schein Dental, Planmeca, Envista Holdings Corporation, SoftDent, Toshiba Medical Systems, Dentrix, Mediware, NextHealth, OpenDental