Regulatory Framework Enhancements

In Spain, the regulatory landscape surrounding the closed system-drug-transfer-device market is evolving, with authorities implementing stricter guidelines to ensure the safe handling of hazardous drugs. These regulations are designed to protect healthcare workers and patients from potential exposure to toxic substances. The Spanish Agency of Medicines and Medical Devices (AEMPS) has been proactive in establishing standards that manufacturers must adhere to, thereby fostering a more secure environment for drug administration. Compliance with these regulations is expected to drive market growth, as healthcare facilities seek to align with legal requirements. The closed system-drug-transfer-device market is likely to benefit from this regulatory push, as it encourages the adoption of safer drug transfer technologies.

Rising Incidence of Chronic Diseases

The prevalence of chronic diseases in Spain is on the rise, leading to an increased demand for effective drug delivery systems. Conditions such as cancer, diabetes, and autoimmune disorders require the administration of hazardous drugs, which necessitates the use of closed system-drug-transfer devices to ensure safe handling. The growing patient population suffering from these chronic conditions is likely to propel the closed system-drug-transfer-device market forward. According to recent health statistics, the incidence of cancer alone is expected to increase by 15% over the next decade, further emphasizing the need for reliable drug transfer solutions. This trend indicates a robust market potential as healthcare providers seek to enhance patient safety and treatment efficacy.

Focus on Cost-Effectiveness in Healthcare

In the context of Spain's healthcare system, there is a growing emphasis on cost-effectiveness, which is influencing the closed system-drug-transfer-device market. Healthcare facilities are increasingly evaluating the economic impact of their purchasing decisions, seeking solutions that not only ensure safety but also provide value for money. Closed system-drug-transfer devices, while initially more expensive, can lead to significant cost savings in the long run by reducing the risk of contamination and associated healthcare costs. This focus on cost-effectiveness is likely to drive the adoption of these devices, as healthcare providers recognize the long-term benefits. The closed system-drug-transfer-device market is expected to thrive as institutions prioritize both safety and economic viability.

Increasing Demand for Safety in Healthcare

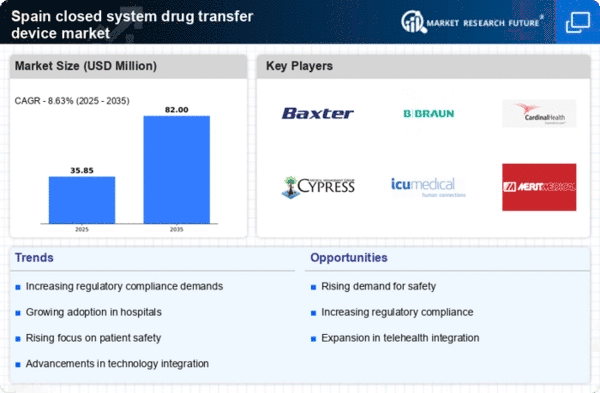

The closed system-drug-transfer-device market in Spain is experiencing a notable surge in demand driven by heightened awareness of safety protocols among healthcare professionals. This demand is largely influenced by the need to minimize exposure to hazardous drugs, which has become a priority in hospitals and clinics. As a result, healthcare facilities are increasingly adopting closed system-drug-transfer devices to ensure the safety of both patients and healthcare workers. The market is projected to grow at a CAGR of approximately 8% over the next five years, reflecting the critical importance of safety in drug handling. This trend indicates a shift towards more stringent safety measures, which is likely to bolster the closed system-drug-transfer-device market significantly.

Technological Innovations in Drug Transfer Systems

The closed system-drug-transfer-device market is witnessing a wave of technological innovations that enhance the efficiency and safety of drug transfer processes. In Spain, manufacturers are investing in research and development to create advanced devices that incorporate features such as automated systems and real-time monitoring. These innovations not only improve the accuracy of drug delivery but also reduce the risk of contamination and exposure to hazardous substances. As a result, healthcare providers are increasingly inclined to adopt these cutting-edge solutions, which are expected to drive market growth. The closed system-drug-transfer-device market is projected to expand as these technological advancements become more prevalent in clinical settings.