Government Initiatives and Funding

Government initiatives and funding aimed at improving healthcare infrastructure are playing a crucial role in shaping the chronic inflammatory-demyelinating-polyneuropathy market in Spain. Recent policies have focused on enhancing research and development in the field of neurology, which may lead to the discovery of new treatment options. Additionally, increased funding for healthcare services is likely to improve access to specialized care for patients suffering from chronic inflammatory-demyelinating-polyneuropathy. This support could manifest in the form of grants for clinical trials or subsidies for innovative therapies, ultimately driving market growth. As the government prioritizes neurological health, the chronic inflammatory-demyelinating-polyneuropathy market may benefit from a more robust healthcare framework.

Advancements in Diagnostic Technologies

Technological advancements in diagnostic tools are significantly impacting the chronic inflammatory-demyelinating-polyneuropathy market in Spain. Enhanced imaging techniques and biomarker identification have improved the accuracy of diagnoses, allowing for earlier intervention and better patient outcomes. For instance, the introduction of advanced electrophysiological tests has enabled healthcare professionals to differentiate chronic inflammatory-demyelinating-polyneuropathy from other neuropathies more effectively. This increased diagnostic precision is likely to lead to a higher number of patients being identified and treated, thereby expanding the market. Furthermore, as awareness of these diagnostic advancements grows among healthcare providers, the chronic inflammatory-demyelinating-polyneuropathy market may see a surge in demand for targeted therapies and management strategies.

Rising Incidence of Neurological Disorders

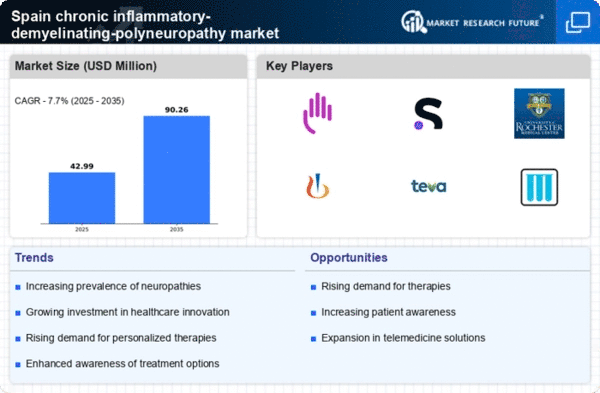

The chronic inflammatory-demyelinating-polyneuropathy market in Spain is experiencing growth due to the rising incidence of neurological disorders. Recent data indicates that neurological conditions are becoming increasingly prevalent, with estimates suggesting that approximately 1 in 6 individuals may be affected by some form of neurological disorder. This trend is likely to drive demand for effective treatments and management options within the chronic inflammatory-demyelinating-polyneuropathy market. As healthcare providers recognize the need for specialized care, the market is expected to expand, with a focus on innovative therapies and patient-centered approaches. The increasing burden of these disorders on the healthcare system may also prompt government initiatives aimed at improving diagnosis and treatment accessibility, further fueling market growth.

Growing Patient Advocacy and Support Groups

The emergence of patient advocacy and support groups is influencing the chronic inflammatory-demyelinating-polyneuropathy market in Spain. These organizations play a vital role in raising awareness about the condition, promoting education, and providing resources for patients and their families. By fostering a community of support, these groups encourage individuals to seek diagnosis and treatment, which may lead to increased market demand. Furthermore, advocacy efforts can drive policy changes and funding allocations that benefit research and treatment options. As these groups continue to grow in influence, they are likely to enhance the visibility of chronic inflammatory-demyelinating-polyneuropathy, thereby positively impacting the market.

Integration of Telemedicine in Patient Care

The integration of telemedicine into patient care is emerging as a transformative factor in the chronic inflammatory-demyelinating-polyneuropathy market in Spain. Telehealth services provide patients with convenient access to specialists, particularly in rural areas where healthcare resources may be limited. This accessibility can lead to earlier diagnosis and ongoing management of chronic inflammatory-demyelinating-polyneuropathy, ultimately improving patient outcomes. Moreover, the adoption of telemedicine may reduce healthcare costs associated with travel and in-person visits, making treatment more affordable for patients. As telehealth continues to gain traction, it is likely to reshape the landscape of the chronic inflammatory-demyelinating-polyneuropathy market, fostering a more patient-centric approach to care.