Rising Cardiovascular Diseases

The increasing prevalence of cardiovascular diseases in Spain is a primary driver for the cardiac implants market. According to recent health statistics, cardiovascular diseases account for approximately 30% of all deaths in the country. This alarming trend necessitates advanced medical interventions, including cardiac implants, to manage and treat these conditions effectively. The aging population, coupled with lifestyle factors such as poor diet and lack of physical activity, contributes to this rise. As a result, healthcare providers are increasingly adopting cardiac implants as a viable solution, leading to a projected growth rate of around 7% annually in the cardiac implants market. This growing demand underscores the urgent need for innovative solutions to combat cardiovascular diseases in Spain.

Government Initiatives and Funding

Government initiatives and funding play a crucial role in shaping the cardiac implants market. In Spain, the government has implemented various health programs aimed at improving cardiovascular health, which includes funding for advanced cardiac treatments. The Spanish Ministry of Health has allocated substantial resources to support research and development in the field of cardiac implants. This financial backing not only encourages innovation but also ensures that patients have access to the latest technologies. As a result, the cardiac implants market is likely to expand, with an anticipated growth of around 5% annually, driven by these supportive government policies and funding initiatives.

Increasing Awareness and Education

Increasing awareness and education regarding cardiovascular health are pivotal in driving the cardiac implants market. Public health campaigns in Spain have focused on educating citizens about the risks associated with heart diseases and the benefits of early intervention. This heightened awareness has led to more individuals seeking medical advice and treatment options, including cardiac implants. Healthcare professionals are also receiving enhanced training on the latest implant technologies, which further promotes their use. Consequently, the cardiac implants market is projected to grow by approximately 4% annually as more patients become informed about their treatment options and the importance of addressing cardiovascular issues promptly.

Aging Population and Demographic Shifts

The aging population in Spain is a significant driver of the cardiac implants market. As the demographic landscape shifts, with a growing proportion of individuals aged 65 and older, the incidence of age-related cardiovascular conditions is on the rise. This demographic trend necessitates the adoption of cardiac implants to manage various heart-related ailments effectively. The cardiac implants market is expected to experience a growth rate of around 6% annually, largely due to the increasing demand for these devices among the elderly population. Furthermore, as life expectancy continues to rise, the need for long-term cardiac solutions will likely become even more pronounced, further propelling market expansion.

Technological Innovations in Cardiac Devices

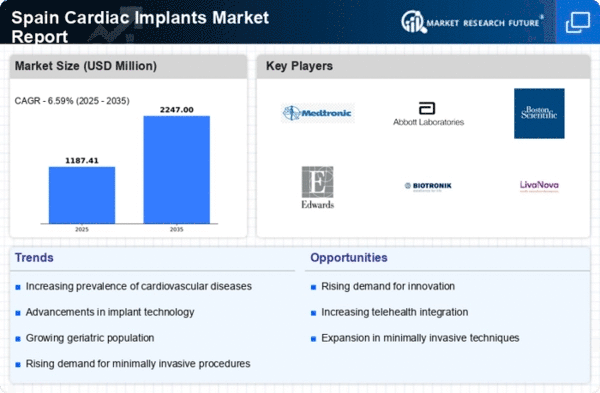

Technological advancements in cardiac devices are significantly influencing the cardiac implants market. Innovations such as bioresorbable stents, advanced pacemakers, and implantable cardioverter-defibrillators (ICDs) are enhancing patient outcomes and driving market growth. In Spain, the introduction of smart cardiac devices that monitor heart activity in real-time is gaining traction. These devices not only improve patient care but also reduce hospital readmission rates, which is a critical concern for healthcare systems. The cardiac implants market is expected to witness a compound annual growth rate (CAGR) of approximately 6% over the next five years, largely due to these technological innovations that enhance the efficacy and safety of cardiac treatments.