Space Situational Awareness Size

Space Situational Awareness Market Growth Projections and Opportunities

The Space Situational Awareness (SSA) market is undergoing significant developments, propelled by key market factors that shape its landscape. A primary driver of this market is the escalating importance of monitoring and understanding activities in space. With an increasing number of satellites, debris, and other objects orbiting the Earth, the need for Space Situational Awareness has grown exponentially. Governments, space agencies, and private entities are investing in SSA capabilities to enhance space traffic management, collision avoidance, and overall space domain awareness.

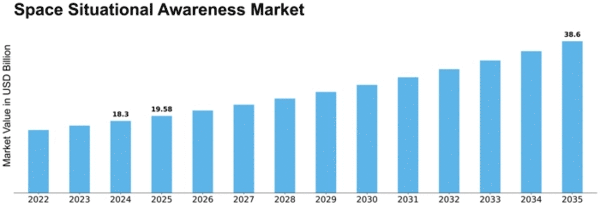

The Space Situational Awareness (SSA) market is anticipated to witness substantial growth, projecting an increase from USD 2.01 billion in 2030, with a Compound Annual Growth Rate (CAGR) of 7% during the period from 2022 to 2030. This market expansion reflects the increasing efforts of individuals and organizations to comprehend the vastness and attributes of outer space enveloping Earth. As the need for understanding and monitoring space activities intensifies, the SSA market continues to evolve, driven by technological advancements and the growing significance of space-related insights.

Technological advancements play a critical role in defining the trajectory of the SSA market. Continuous innovation in sensor technologies, data analytics, and artificial intelligence has bolstered the capabilities of SSA systems. Advanced sensors enable the detection and tracking of space objects with greater accuracy, while sophisticated analytics and AI algorithms process vast amounts of data, providing actionable insights for space operators. These technological enhancements not only improve the effectiveness of SSA but also contribute to the development of more robust and scalable solutions.

Regulatory considerations are another pivotal factor influencing the SSA market. As space activities increase, regulatory frameworks are evolving to address safety, sustainability, and responsible space behavior. Compliance with these regulations is essential for space operators and organizations, shaping the design and implementation of SSA solutions. The integration of SSA capabilities becomes crucial for meeting regulatory requirements related to collision avoidance, space debris mitigation, and overall space domain awareness.

The competitive landscape in the SSA market is marked by a growing number of players offering diverse solutions. Collaboration and partnerships between governments, space agencies, and private companies are common strategies to harness complementary strengths and advance SSA capabilities. The competitive dynamics foster innovation and the development of specialized SSA services, such as conjunction analysis, anomaly detection, and space weather monitoring, contributing to the overall growth of the market.

Economic factors also contribute to the dynamics of the SSA market. The increasing commercialization of space activities, including satellite launches, space tourism, and communication services, drives the demand for SSA services. Companies engaged in space-related ventures recognize the importance of protecting their assets and ensuring the safe operation of their spacecraft, making SSA an integral component of their business strategies. The economic viability of these ventures is closely tied to the effectiveness of SSA solutions in mitigating risks and enhancing overall space operations.

Global geopolitical considerations further impact the SSA market. Space has become a contested domain, and nations are recognizing the strategic importance of space assets. Heightened security concerns and the potential militarization of space emphasize the need for comprehensive SSA capabilities. As countries aim to protect their satellites and space infrastructure, investments in advanced SSA technologies become imperative, influencing the overall market dynamics.

Leave a Comment