Government Regulations and Support

Government regulations and support play a crucial role in shaping the pipe laying-vessel market. South Korea's regulatory framework encourages investments in maritime infrastructure and environmental protection. The government has implemented policies that promote the use of eco-friendly technologies in vessel operations, which aligns with global sustainability goals. Additionally, financial incentives for companies investing in advanced vessel technologies are likely to stimulate market growth. The South Korean government has earmarked approximately $5 billion for maritime innovation and infrastructure development over the next decade. This supportive environment is expected to foster growth in the pipe laying-vessel market, as companies seek to comply with regulations while enhancing their operational capabilities.

Increased International Collaboration

Increased international collaboration in the maritime sector is emerging as a significant driver for the pipe laying-vessel market. South Korea has been actively engaging in partnerships with other countries to enhance its maritime capabilities and share technological advancements. Collaborative projects, particularly in offshore energy development, are likely to create new opportunities for the pipe laying-vessel market. For instance, joint ventures with international firms can lead to the sharing of resources and expertise, thereby improving operational efficiencies. This trend indicates a potential for growth in the market, as South Korean companies leverage international partnerships to enhance their competitiveness and expand their service offerings.

Expansion of Renewable Energy Projects

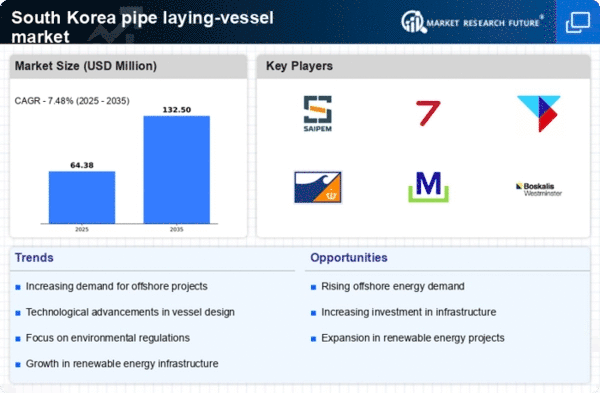

The push towards renewable energy sources in South Korea is driving the pipe laying-vessel market. The government aims to generate 20 % of its energy from renewable sources by 2030, which necessitates the development of offshore wind farms and solar energy projects. These initiatives require extensive underwater cabling and pipeline installations, thereby increasing the demand for specialized vessels. The anticipated investment in offshore wind energy alone is projected to reach $43 billion by 2030. This focus on renewable energy not only supports environmental goals but also stimulates the pipe laying-vessel market, as companies will need advanced vessels to facilitate the installation of necessary infrastructure.

Rising Demand for Energy Infrastructure

The increasing demand for energy infrastructure in South Korea is a primary driver for the pipe laying-vessel market. As the nation seeks to enhance its energy security and diversify its energy sources, investments in offshore oil and gas projects are expected to rise. The government has allocated approximately $10 billion for energy infrastructure development over the next five years, which includes the construction of pipelines. This surge in investment is likely to create a robust demand for specialized vessels capable of laying pipes efficiently in challenging marine environments. Consequently, the pipe laying-vessel market is poised to benefit significantly from these developments, as companies will require advanced vessels to meet the growing needs of the energy sector.

Technological Innovations in Vessel Design

Technological innovations in vessel design are significantly influencing the pipe laying-vessel market. The introduction of advanced materials and automation technologies enhances the efficiency and safety of pipe laying operations. For instance, the development of dynamic positioning systems allows vessels to maintain precise locations during installation, reducing operational risks. Furthermore, the integration of real-time monitoring systems improves project management and reduces downtime. As South Korean companies increasingly adopt these innovations, the demand for modern pipe laying vessels is likely to rise. This trend suggests that the market will continue to evolve, with a focus on enhancing operational capabilities and reducing environmental impacts.