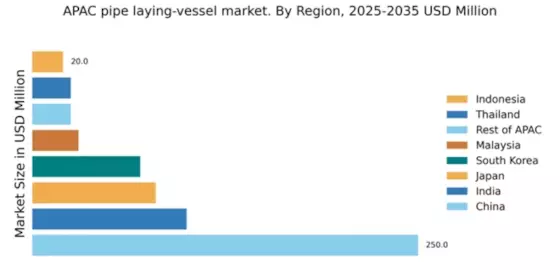

China : Robust Growth and Infrastructure Development

China holds a commanding market share of 250.0, representing a significant portion of the APAC pipe laying-vessel market. Key growth drivers include massive investments in infrastructure, particularly in energy and telecommunications sectors. The government's commitment to renewable energy projects and the Belt and Road Initiative are pivotal in shaping demand trends. Regulatory policies favoring foreign investments and local manufacturing further enhance market dynamics, while urbanization continues to drive consumption patterns.

India : Infrastructure Push Fuels Demand

India's market value stands at 100.0, reflecting a growing demand for pipe laying vessels driven by infrastructure projects and urban development. The government's initiatives, such as the National Infrastructure Pipeline, aim to boost investment in transportation and energy sectors. This regulatory support is crucial for attracting foreign players and enhancing local capabilities. Demand is particularly strong in urban areas, where industrial growth is accelerating consumption patterns.

Japan : Innovation Drives Competitive Advantage

Japan's market value is 80.0, characterized by a stable demand for advanced pipe laying technologies. The country's focus on innovation and sustainability in energy projects, particularly offshore wind farms, is a key growth driver. Regulatory frameworks support environmental standards, promoting the adoption of cutting-edge technologies. The aging infrastructure also necessitates upgrades, further fueling demand for specialized vessels.

South Korea : Strong Industrial Base and Expertise

South Korea's market value is 70.0, supported by a robust marine engineering sector. The government's focus on expanding offshore energy projects, including oil and gas exploration, drives demand for pipe laying vessels. Regulatory policies encourage technological advancements and partnerships with global players. Key cities like Busan and Ulsan are central to this market, fostering a competitive landscape with major players like Samsung Heavy Industries and Daewoo Shipbuilding.

Malaysia : Investment in Energy Sector Expansion

Malaysia's market value is 30.0, with growth driven by investments in oil and gas infrastructure. The government's initiatives to enhance energy security and promote renewable energy projects are pivotal. Regulatory frameworks support foreign investments, creating a conducive environment for market players. Demand is concentrated in states like Sarawak and Sabah, where offshore projects are prevalent, attracting major players like Sapura Energy.

Thailand : Government Initiatives Boost Demand

Thailand's market value is 25.0, reflecting a developing landscape for pipe laying vessels. The government's focus on infrastructure development, particularly in transportation and energy, is a key growth driver. Regulatory policies support public-private partnerships, enhancing investment opportunities. Key markets include Bangkok and Rayong, where industrial activities are concentrated, attracting both local and international players.

Indonesia : Natural Resources Drive Demand Growth

Indonesia's market value is 20.0, driven by its rich natural resources and growing energy sector. The government's focus on infrastructure development and energy security is crucial for market expansion. Regulatory frameworks are evolving to attract foreign investments, particularly in offshore projects. Key regions include Sumatra and Java, where demand for pipe laying vessels is increasing due to ongoing oil and gas exploration activities.

Rest of APAC : Regional Growth Across Multiple Sectors

The Rest of APAC market value is 25.0, encompassing diverse countries with varying demand for pipe laying vessels. Growth is driven by regional infrastructure projects and energy sector developments. Regulatory policies differ significantly, impacting market dynamics. Countries like Vietnam and the Philippines are emerging markets, attracting investments in energy and telecommunications, creating opportunities for major players in the sector.