South Korea Organic Natural Tampons Market Summary

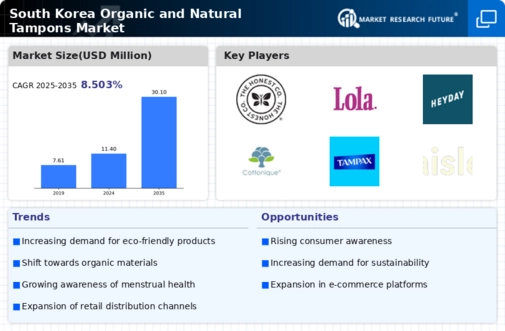

The South Korea Organic and Natural Tampons market is projected to experience substantial growth from 250 USD Million in 2024 to 750 USD Million by 2035.

Key Market Trends & Highlights

South Korea Organic and Natural Tampons Key Trends and Highlights

- The market is expected to grow at a compound annual growth rate of 10.5% from 2025 to 2035.

- By 2035, the market valuation is anticipated to reach 750 USD Million, indicating robust demand.

- In 2024, the market is valued at 250 USD Million, reflecting a growing consumer preference for organic products.

- Growing adoption of organic and natural products due to increasing health awareness is a major market driver.

Market Size & Forecast

| 2024 Market Size | 250 (USD Million) |

| 2035 Market Size | 750 (USD Million) |

| CAGR (2025 - 2035) | 10.5% |

Major Players

Apple Inc (US), Microsoft Corp (US), Amazon.com Inc (US), Alphabet Inc (US), Berkshire Hathaway Inc (US), Tesla Inc (US), Meta Platforms Inc (US), Johnson & Johnson (US), Visa Inc (US), Procter & Gamble Co (US)