Supportive Government Policies

Supportive government policies in South America are playing a crucial role in shaping the Viral Vectors And Plasmid Dna Manufacturing Market. Regulatory bodies are increasingly recognizing the importance of biotechnology in healthcare and are implementing frameworks that facilitate research and commercialization. For example, Brazil's National Health Surveillance Agency has streamlined approval processes for gene therapies, encouraging companies to invest in local manufacturing. Additionally, initiatives aimed at fostering public-private partnerships are emerging, which can enhance resource sharing and innovation. These favorable policies are likely to create a conducive environment for the growth of the market, as they not only reduce barriers to entry but also promote collaboration among stakeholders in the biotechnology sector.

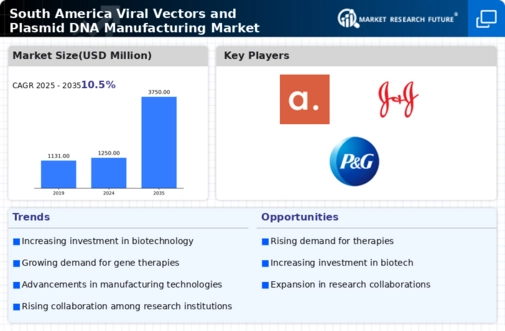

Increasing Investment in Biotechnology

The South America Viral Vectors And Plasmid Dna Manufacturing Market is experiencing a surge in investment, driven by both public and private sectors. Governments in countries like Brazil and Argentina are allocating substantial funds to biotechnology research and development. This financial support is crucial for enhancing manufacturing capabilities and fostering innovation in viral vector and plasmid DNA technologies. In 2025, the biotechnology sector in Brazil alone attracted over 1 billion USD in investments, indicating a robust growth trajectory. Such investments not only bolster local manufacturing but also position South America as a competitive player in the global market. The influx of capital is likely to accelerate advancements in gene therapies and vaccines, thereby expanding the market's potential significantly.

Growing Prevalence of Genetic Disorders

The rising incidence of genetic disorders in South America is a pivotal driver for the Viral Vectors And Plasmid Dna Manufacturing Market. Conditions such as cystic fibrosis, hemophilia, and various inherited metabolic disorders are becoming increasingly prevalent, necessitating innovative treatment solutions. The demand for gene therapies, which often utilize viral vectors and plasmid DNA, is expected to rise sharply as healthcare providers seek effective interventions. According to recent health statistics, genetic disorders affect approximately 1 in 200 individuals in the region, underscoring the urgent need for advanced therapeutic options. This growing patient population is likely to propel the market forward, as pharmaceutical companies invest in developing targeted therapies that leverage viral vector technologies.

Rising Demand for Personalized Medicine

The trend towards personalized medicine is gaining momentum in South America, significantly impacting the Viral Vectors And Plasmid Dna Manufacturing Market. As healthcare shifts towards tailored therapies that cater to individual patient profiles, the need for advanced manufacturing capabilities becomes paramount. Viral vectors and plasmid DNA are integral to developing personalized gene therapies, which are increasingly being recognized for their potential to treat a variety of conditions more effectively. The market for personalized medicine in South America is projected to grow at a compound annual growth rate of over 10% in the coming years. This growing demand is likely to drive investments in manufacturing technologies and capabilities, thereby enhancing the overall landscape of the viral vector and plasmid DNA market.

Advancements in Manufacturing Technologies

Technological advancements in the manufacturing processes of viral vectors and plasmid DNA are significantly influencing the South America Viral Vectors And Plasmid Dna Manufacturing Market. Innovations such as improved cell culture techniques, purification methods, and scalable production systems are enhancing the efficiency and yield of viral vector production. For instance, the adoption of continuous manufacturing processes is expected to reduce production costs and time, making therapies more accessible. As these technologies evolve, they are likely to attract more players into the market, fostering competition and driving down prices. This technological evolution not only supports existing therapeutic developments but also opens avenues for new applications in vaccine production and gene editing, thereby expanding the market landscape.