Growing Aging Population

The increasing aging population in South America is a pivotal driver for the radiology services market. As individuals age, they often experience a higher incidence of chronic diseases and conditions requiring diagnostic imaging. This demographic shift is projected to elevate the demand for radiology services, as older adults typically require more frequent imaging studies. According to recent estimates, the population aged 65 and older in South America is expected to reach approximately 15% by 2030. This trend suggests a substantial increase in the utilization of radiological services, thereby propelling market growth. Healthcare providers are likely to expand their radiology departments to accommodate this rising demand, which may lead to enhanced service offerings and technological investments in imaging equipment.

Increased Healthcare Expenditure

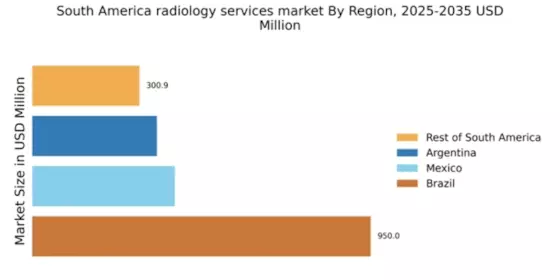

Rising healthcare expenditure in South America is a crucial driver for the radiology services market. Governments and private sectors are allocating more funds towards healthcare infrastructure, which includes the expansion of radiology services. For instance, healthcare spending in countries like Brazil and Argentina has seen a steady increase, with projections indicating a growth rate of around 5% annually. This financial commitment is likely to facilitate the acquisition of advanced imaging technologies and the hiring of specialized personnel, thereby enhancing the quality and accessibility of radiology services. As healthcare systems evolve, the demand for comprehensive radiological assessments is expected to rise, further propelling market growth in the region.

Rising Incidence of Chronic Diseases

The prevalence of chronic diseases in South America is a significant factor influencing the radiology services market. Conditions such as cardiovascular diseases, diabetes, and cancer are on the rise, necessitating advanced diagnostic imaging for effective management and treatment. For instance, cancer cases in South America are projected to increase by over 20% in the next decade, leading to a heightened need for radiological assessments. This surge in chronic conditions is likely to drive healthcare systems to invest more in radiology services, ensuring timely and accurate diagnoses. Consequently, the radiology services market is expected to expand as healthcare providers seek to enhance their diagnostic capabilities to address the growing burden of chronic diseases.

Technological Integration in Healthcare

The integration of advanced technologies in healthcare is transforming the radiology services market in South America. Innovations such as artificial intelligence (AI), machine learning, and telemedicine are enhancing the efficiency and accuracy of diagnostic imaging. AI algorithms can assist radiologists in interpreting images more effectively, potentially reducing diagnostic errors. Furthermore, tele-radiology services are becoming increasingly popular, allowing for remote consultations and interpretations, which is particularly beneficial in rural areas with limited access to specialists. This technological evolution is likely to attract investments in radiology services, as healthcare providers aim to improve patient outcomes and streamline operations. The market may witness a shift towards more sophisticated imaging modalities, thereby expanding the scope of radiological services offered.

Growing Awareness of Preventive Healthcare

There is a notable increase in awareness regarding preventive healthcare among the South American population, which is positively impacting the radiology services market. As individuals become more informed about the importance of early detection and diagnosis, the demand for routine imaging services is likely to rise. Public health campaigns and educational initiatives are encouraging people to undergo regular screenings, particularly for conditions such as breast and cervical cancer. This shift towards preventive care is expected to drive the utilization of radiology services, as healthcare providers respond to the growing need for diagnostic imaging. Consequently, the radiology services market may experience significant growth as more individuals seek preventive imaging solutions.