Supportive Regulatory Frameworks

The protein engineering market in South America benefits from supportive regulatory frameworks that encourage innovation and research. Governments in the region are increasingly recognizing the importance of biotechnology in addressing health and agricultural challenges. This has led to the establishment of policies that facilitate the approval and commercialization of biotechnological products. The protein engineering market is likely to thrive under these favorable conditions, as streamlined regulatory processes can accelerate the development and market entry of new protein-based therapies and agricultural solutions.

Advancements in Genomic Technologies

Technological advancements in genomic research are significantly impacting the protein engineering market in South America. The advent of CRISPR and other gene-editing technologies has enabled researchers to manipulate proteins with unprecedented precision. This has led to the development of tailored proteins for specific applications, enhancing the efficacy of therapeutic interventions. The protein engineering market is likely to see increased investment in these technologies, as they offer the potential to revolutionize drug development processes. Furthermore, the integration of bioinformatics tools is expected to streamline protein design, thereby accelerating the pace of innovation in the region.

Rising Demand for Biopharmaceuticals

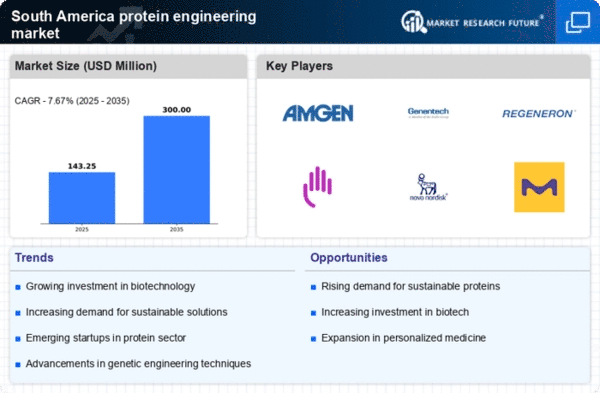

The protein engineering market in South America is experiencing a notable surge in demand for biopharmaceuticals. This trend is driven by the increasing prevalence of chronic diseases and the need for innovative therapies. According to recent data, the biopharmaceutical sector in South America is projected to grow at a CAGR of approximately 8% over the next five years. This growth is likely to stimulate advancements in protein engineering, as companies seek to develop more effective and targeted treatments. The protein engineering market is thus positioned to benefit from this rising demand, as it plays a crucial role in the development of novel therapeutic proteins and monoclonal antibodies.

Growing Agricultural Biotechnology Sector

The agricultural biotechnology sector in South America is expanding, which is positively influencing the protein engineering market. With the increasing need for sustainable agricultural practices, there is a rising interest in genetically modified organisms (GMOs) that can enhance crop yields and resistance to pests. The protein engineering market is likely to play a pivotal role in developing these GMOs, as it focuses on designing proteins that can improve plant traits. Recent estimates suggest that the agricultural biotechnology market in South America could reach $10 billion by 2027, further driving demand for protein engineering solutions.

Increased Collaboration Among Stakeholders

Collaboration among various stakeholders, including academic institutions, research organizations, and private companies, is fostering growth in the protein engineering market in South America. These partnerships are essential for sharing knowledge, resources, and expertise, which can lead to innovative solutions in protein design and application. The protein engineering market is expected to benefit from this collaborative environment, as it enhances the potential for breakthroughs in therapeutic development and agricultural applications. Recent initiatives have shown that such collaborations can significantly reduce the time and cost associated with bringing new products to market.