Advancements in Biotechnology

Technological advancements in biotechnology are playing a pivotal role in shaping the South America Pectinase Market. Innovations in enzyme production and application techniques are enhancing the efficiency and effectiveness of pectinase. For instance, the development of genetically modified microorganisms for enzyme production has the potential to increase yield and reduce costs. In 2025, the biotechnology sector in South America was projected to grow at a compound annual growth rate of 7%, indicating a robust environment for pectinase applications. This growth is likely to encourage investments in research and development, further propelling the South America Pectinase Market as companies seek to optimize their production processes and meet the rising demand for high-quality pectinase.

Increasing Health Consciousness

The rising health consciousness among consumers in South America is significantly influencing the South America Pectinase Market. As individuals become more aware of the health benefits associated with natural ingredients, the demand for pectinase, known for its role in enhancing dietary fiber content, is expected to rise. In 2025, the health food market in South America was estimated to reach USD 30 billion, with a growing segment focused on functional foods. This trend suggests that food manufacturers are likely to incorporate pectinase into their products to cater to health-conscious consumers. Consequently, the South America Pectinase Market is poised for growth as manufacturers adapt to changing consumer preferences and prioritize health-oriented formulations.

Growing Food and Beverage Sector

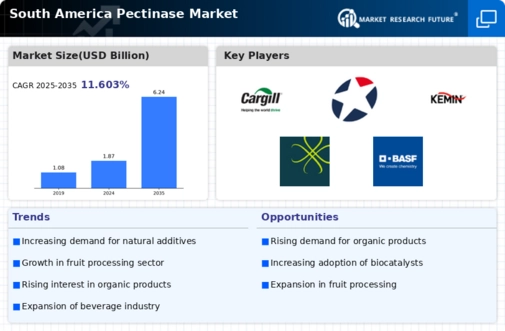

The South America Pectinase Market is experiencing a notable surge due to the expanding food and beverage sector. As consumer preferences shift towards natural and organic products, the demand for pectinase, a natural enzyme, is likely to increase. In 2025, the food and beverage industry in South America was valued at approximately USD 200 billion, with projections indicating a steady growth rate of 5% annually. This growth is expected to drive the need for pectinase in juice clarification, fruit processing, and wine production, thereby enhancing the overall market dynamics. The increasing focus on quality and efficiency in food processing is anticipated to further bolster the demand for pectinase, positioning it as a critical component in the South America Pectinase Market.

Regulatory Support for Natural Ingredients

Regulatory frameworks in South America are increasingly favoring the use of natural ingredients in food production, which is beneficial for the South America Pectinase Market. Governments are implementing policies that promote the use of enzymes derived from natural sources, thereby encouraging food manufacturers to adopt pectinase in their processes. In 2025, several South American countries introduced regulations aimed at reducing synthetic additives in food products, which is likely to drive the demand for natural alternatives like pectinase. This regulatory support not only enhances consumer trust but also positions pectinase as a preferred choice among food producers, thereby fostering growth in the South America Pectinase Market.

Expansion of the Juice and Beverage Industry

The expansion of the juice and beverage industry in South America is a significant driver for the South America Pectinase Market. With a growing population and increasing disposable incomes, the demand for fruit juices and beverages is on the rise. In 2025, the juice market in South America was valued at approximately USD 15 billion, with expectations of continued growth. Pectinase plays a crucial role in juice production by improving yield and clarity, making it an essential ingredient for manufacturers. As the beverage industry continues to innovate and expand, the demand for pectinase is likely to increase, thereby positively impacting the South America Pectinase Market.