Advancements in Pharmaceutical Research

Recent advancements in pharmaceutical research are significantly influencing the neuropathic pain market in South America. The development of novel analgesics and adjuvant medications, such as anticonvulsants and antidepressants, has opened new avenues for effective pain management. Clinical trials and research initiatives are increasingly focusing on the efficacy of these treatments, with some studies indicating that certain medications can reduce pain levels by up to 50%. This progress not only enhances treatment options but also encourages healthcare professionals to adopt these therapies, thereby driving market growth. As the pharmaceutical landscape evolves, the neuropathic pain market is expected to benefit from a wider array of effective treatment modalities.

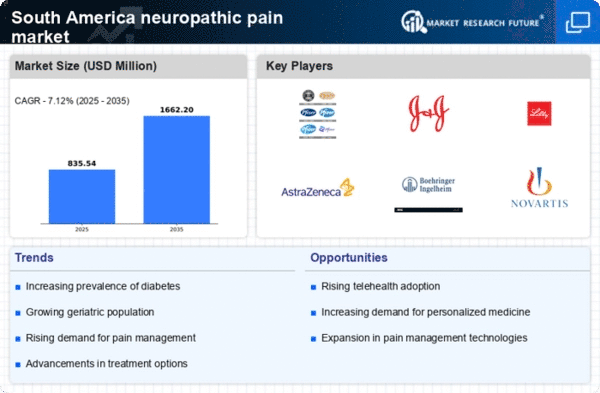

Increasing Incidence of Neuropathic Disorders

The rising incidence of neuropathic disorders in South America is a critical driver for the neuropathic pain market. Conditions such as diabetic neuropathy and postherpetic neuralgia are becoming more prevalent, largely due to lifestyle changes and an aging population. According to health statistics, the prevalence of diabetes in South America is projected to reach 10% by 2030, which correlates with an increase in neuropathic pain cases. This growing patient population necessitates effective pain management solutions, thereby propelling the demand for neuropathic pain treatments. As healthcare providers seek to address this rising burden, the neuropathic pain market is likely to expand, with a focus on innovative therapies and medications tailored to these conditions.

Enhanced Patient Education and Support Programs

Enhanced patient education and support programs are emerging as a vital driver for the neuropathic pain market in South America. As awareness of neuropathic pain increases, healthcare providers are implementing educational initiatives to inform patients about their conditions and treatment options. These programs aim to empower patients, enabling them to make informed decisions regarding their pain management strategies. Research indicates that patients who participate in educational programs report higher satisfaction levels and improved pain outcomes. Consequently, the neuropathic pain market is likely to benefit from this trend, as informed patients are more likely to seek appropriate treatments and adhere to prescribed therapies.

Growing Investment in Healthcare Infrastructure

The growing investment in healthcare infrastructure across South America is a pivotal driver for the neuropathic pain market. Governments and private entities are increasingly allocating funds to enhance healthcare facilities and services, which includes pain management programs. This investment is crucial for improving access to treatment for patients suffering from neuropathic pain. Enhanced healthcare infrastructure facilitates the introduction of specialized pain clinics and multidisciplinary treatment approaches, which are essential for effective management of neuropathic conditions. As a result, the neuropathic pain market is likely to experience growth, as more patients gain access to comprehensive care and innovative treatment options.

Rising Demand for Non-Opioid Pain Management Solutions

The rising demand for non-opioid pain management solutions is reshaping the neuropathic pain market in South America. With increasing concerns regarding opioid dependency and side effects, healthcare providers and patients are seeking alternative therapies. Non-opioid medications, such as topical agents and neuromodulators, are gaining traction as effective options for managing neuropathic pain. Market data suggests that the non-opioid segment is expected to grow at a CAGR of over 8% in the coming years. This shift towards safer pain management alternatives is likely to drive innovation and investment in the neuropathic pain market, as stakeholders respond to the evolving needs of patients.

Leave a Comment