Government Initiatives and Funding

Government policies and funding initiatives play a pivotal role in shaping the hospital services market in South America. Many countries in the region are increasing their healthcare budgets to improve access and quality of care. For instance, Brazil's government has allocated an additional $1 billion to enhance public hospital services, aiming to reduce wait times and improve patient satisfaction. Such initiatives are likely to stimulate growth in the hospital services market, as they encourage the expansion of facilities and the hiring of additional healthcare professionals. Moreover, public health campaigns aimed at disease prevention and health education are expected to further drive demand for hospital services, as they promote proactive healthcare engagement among the population.

Focus on Patient-Centric Care Models

The shift towards patient-centric care models is reshaping the hospital services market in South America. Hospitals are increasingly prioritizing patient experience and satisfaction, recognizing that these factors are crucial for retention and positive health outcomes. This trend is reflected in the implementation of personalized care plans and enhanced communication strategies between healthcare providers and patients. Research indicates that hospitals adopting patient-centric approaches may see a 20% increase in patient satisfaction scores. Additionally, the emphasis on holistic care is prompting hospitals to integrate mental health services and wellness programs into their offerings. This comprehensive approach not only addresses the physical health needs of patients but also fosters a more supportive healthcare environment, thereby driving growth in the hospital services market.

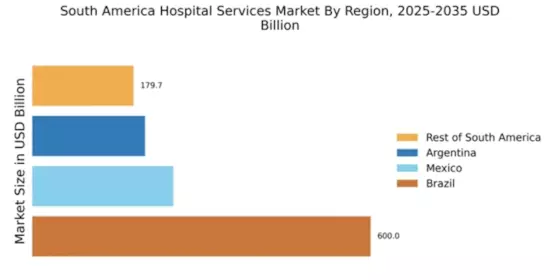

Increasing Health Insurance Coverage

The expansion of health insurance coverage across South America is significantly impacting the hospital services market. As more individuals gain access to health insurance, the demand for hospital services is likely to rise. Recent data suggests that health insurance penetration in the region has increased by approximately 15% over the past five years, leading to a greater number of insured patients seeking medical care. This trend is particularly evident in countries like Argentina and Chile, where government initiatives have facilitated access to affordable health plans. Consequently, hospitals are adapting their service models to accommodate the influx of insured patients, which may lead to increased competition and improved service quality in the hospital services market.

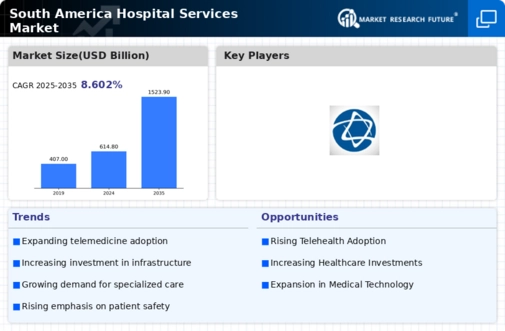

Rising Demand for Specialized Services

The hospital services market in South America is experiencing a notable increase in demand for specialized medical services. This trend is driven by a growing population with diverse healthcare needs, particularly in urban areas. As the population ages, the prevalence of chronic diseases rises, necessitating specialized care. For instance, the demand for oncology and cardiology services has surged, with projections indicating a growth rate of approximately 8% annually in these sectors. Hospitals are thus compelled to enhance their service offerings to meet this demand, which in turn stimulates investment in advanced medical technologies and training for healthcare professionals. This shift towards specialization is reshaping the hospital services market, as facilities strive to attract patients seeking high-quality, targeted care.

Technological Advancements in Healthcare

Technological innovations are significantly influencing the hospital services market in South America. The integration of advanced medical technologies, such as telemedicine, electronic health records, and robotic surgery, is transforming patient care delivery. Hospitals are increasingly adopting these technologies to improve operational efficiency and enhance patient outcomes. For example, the implementation of telehealth services has expanded access to care, particularly in remote areas, potentially increasing patient engagement by up to 30%. Furthermore, investments in health IT infrastructure are projected to reach $5 billion by 2026, indicating a robust commitment to modernization. These advancements not only streamline hospital operations but also elevate the overall quality of care, making technology a crucial driver in the evolving landscape of hospital services.