Shift Towards Value-Based Care Models

The transition from volume-based to value-based care models is reshaping the healthcare landscape in South America, thereby influencing the healthcare CRM market. This shift emphasizes the quality of care over the quantity of services provided, prompting healthcare organizations to adopt CRM systems that facilitate better patient management and outcomes tracking. By leveraging CRM technology, providers can monitor patient progress and adjust treatment plans accordingly, which is essential in a value-based care framework. As more organizations embrace this model, the demand for healthcare CRM solutions is likely to grow, with estimates suggesting a potential increase of 15% in market size over the next few years. This evolution in care delivery is expected to drive the adoption of CRM systems that support value-based initiatives.

Government Initiatives for Digital Health

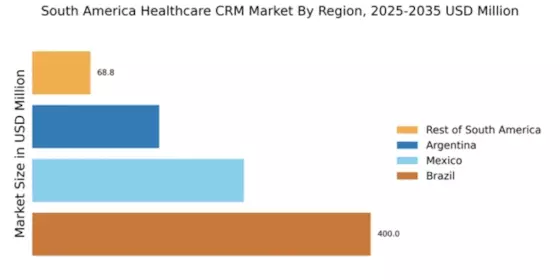

Government initiatives aimed at promoting digital health solutions are significantly influencing the healthcare CRM market in South America. Various countries in the region are implementing policies that encourage the adoption of technology in healthcare, including CRM systems. For instance, Brazil's Ministry of Health has launched programs to digitize patient records and improve healthcare delivery. These initiatives are expected to increase the penetration of CRM solutions, with projections indicating a growth rate of 20% in the next five years. By facilitating better data management and patient engagement, these government efforts are likely to enhance the overall efficiency of healthcare services, thereby propelling the healthcare CRM market forward.

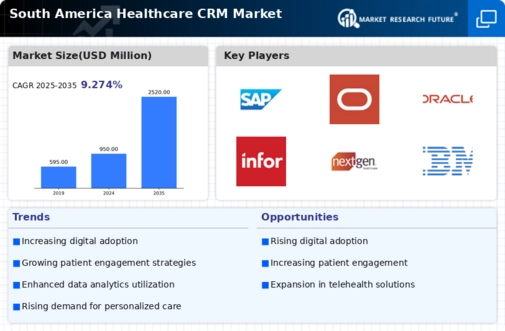

Rising Demand for Personalized Healthcare

The Healthcare CRM market in South America is experiencing a notable surge in demand for personalized healthcare solutions. This trend is driven by an increasing awareness among patients regarding their health needs and preferences. As healthcare providers strive to enhance patient satisfaction, they are adopting CRM systems that enable tailored communication and services. According to recent data, approximately 65% of healthcare organizations in South America are prioritizing personalized care strategies. This shift not only improves patient outcomes but also fosters loyalty, thereby driving growth in the healthcare CRM market. The ability to analyze patient data and preferences enables providers to offer customized treatment plans, which is becoming a critical factor in the competitive landscape of the healthcare sector.

Growing Focus on Data Security and Compliance

As the healthcare sector in South America becomes increasingly digitized, the focus on data security and compliance is intensifying. Healthcare organizations are recognizing the importance of safeguarding patient information, which is driving the adoption of CRM systems equipped with robust security features. The Healthcare CRM market is responding to this need, with many providers enhancing their offerings to include advanced encryption and compliance with regulations such as the General Data Protection Law (LGPD) in Brazil. This regulatory framework mandates strict data protection measures, and organizations that fail to comply may face substantial fines. Consequently, the emphasis on data security is likely to stimulate growth in the healthcare CRM market, as organizations seek solutions that ensure compliance while maintaining patient trust.

Increased Investment in Healthcare Technology

Investment in healthcare technology is on the rise in South America, which is positively impacting the healthcare CRM market. With healthcare providers recognizing the need for efficient management systems, there is a growing allocation of funds towards CRM solutions. Reports indicate that healthcare technology investments in the region are expected to reach $10 billion by 2026, with a significant portion directed towards CRM systems. This influx of capital is likely to drive innovation and enhance the capabilities of healthcare CRM solutions, making them more attractive to providers. As organizations seek to improve operational efficiency and patient engagement, the healthcare CRM market stands to benefit from this trend of increased investment.