Rising Healthcare Expenditure

Healthcare expenditure in South America is on the rise, which positively impacts the dyspepsia market. Increased investment in healthcare infrastructure and services allows for better access to diagnostic and therapeutic options for dyspepsia. Governments and private sectors are allocating more funds towards healthcare, with spending projected to reach approximately $1 trillion by 2025. This financial commitment facilitates the availability of advanced treatments and medications, thereby enhancing patient outcomes. As healthcare systems evolve, the dyspepsia market is likely to experience growth driven by improved access to care and innovative treatment modalities.

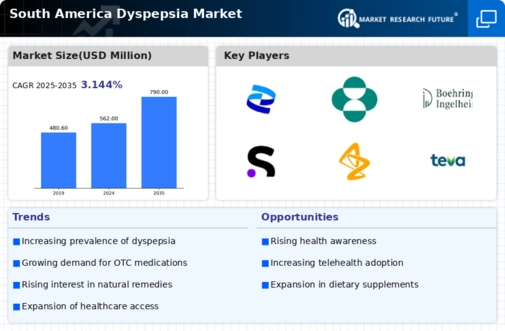

Increasing Prevalence of Dyspepsia

The rising incidence of dyspepsia in South America appears to be a significant driver for the dyspepsia market. Studies indicate that approximately 20-30% of the population experiences dyspeptic symptoms, which may be attributed to dietary habits, stress, and lifestyle changes. This growing prevalence necessitates the development and availability of effective treatment options, thereby stimulating market growth. As healthcare providers increasingly recognize the need for targeted therapies, the dyspepsia market is likely to expand. Furthermore, the economic burden associated with dyspepsia, including healthcare costs and lost productivity, underscores the urgency for innovative solutions in this sector.

Shift Towards Preventive Healthcare

There is a noticeable shift towards preventive healthcare in South America, which is influencing the dyspepsia market. Consumers are becoming more proactive about their health, seeking to prevent gastrointestinal disorders before they arise. This trend is reflected in the increasing demand for dietary supplements and functional foods that promote digestive health. The market for probiotics, for instance, is projected to grow at a CAGR of around 8% over the next few years. As individuals prioritize wellness and preventive measures, the dyspepsia market is likely to benefit from this evolving consumer behavior, leading to a broader range of products and services.

Growing Demand for Personalized Medicine

The trend towards personalized medicine is gaining traction in South America, influencing the dyspepsia market. Patients are increasingly seeking tailored treatment options that consider their unique genetic, environmental, and lifestyle factors. This demand for personalized approaches is prompting pharmaceutical companies to develop targeted therapies for dyspepsia, which may lead to improved efficacy and patient satisfaction. The market for personalized medicine is expected to grow significantly, with estimates suggesting a CAGR of around 10% over the next few years. As healthcare providers adopt more individualized treatment strategies, the dyspepsia market is likely to expand in response to this evolving landscape.

Regulatory Support for Innovative Treatments

Regulatory bodies in South America are increasingly supportive of innovative treatments for dyspepsia, which is a crucial driver for the dyspepsia market. Streamlined approval processes for new medications and therapies encourage pharmaceutical companies to invest in research and development. This regulatory environment fosters innovation, allowing for the introduction of novel therapies that address unmet needs in dyspepsia management. As a result, the market is expected to witness a surge in new product launches, enhancing treatment options for patients. The potential for reimbursement policies to cover these innovative treatments further strengthens the market landscape.