Government Support and Initiatives

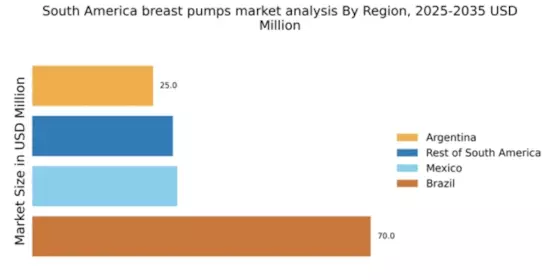

Government initiatives aimed at promoting breastfeeding and maternal health are pivotal in shaping the breast pumps market. In South America, various governments have implemented policies that support breastfeeding, including maternity leave regulations and breastfeeding-friendly workplace initiatives. These policies encourage mothers to breastfeed longer, thereby increasing the demand for breast pumps. For instance, countries like Brazil have seen a rise in breastfeeding rates due to supportive legislation, which correlates with a growing market for breast pumps. The breast pumps market is likely to benefit from ongoing government support, fostering a culture that values breastfeeding.

Cultural Shifts Towards Working Mothers

Cultural shifts in South America towards the acceptance of working mothers are influencing the breast pumps market. As more women enter the workforce, the need for breast pumps has become increasingly apparent. Many mothers seek solutions that allow them to balance their professional and personal lives while continuing to breastfeed. This societal change has led to a greater demand for efficient and portable breast pumps that can be used in various settings. The breast pumps market is expected to grow as more products are developed to meet the needs of working mothers, reflecting changing attitudes towards motherhood and employment.

Rising Disposable Income Among Consumers

The increase in disposable income among consumers in South America is a significant driver for the breast pumps market. As economic conditions improve, more families are willing to invest in quality breastfeeding products, including breast pumps. This trend is particularly evident in urban areas where the middle class is expanding. Market data indicates that the average spending on baby care products, including breast pumps, has risen by approximately 15% over the past few years. This increase in purchasing power allows families to prioritize health and convenience, thereby boosting the breast pumps market.

Technological Advancements in Pump Design

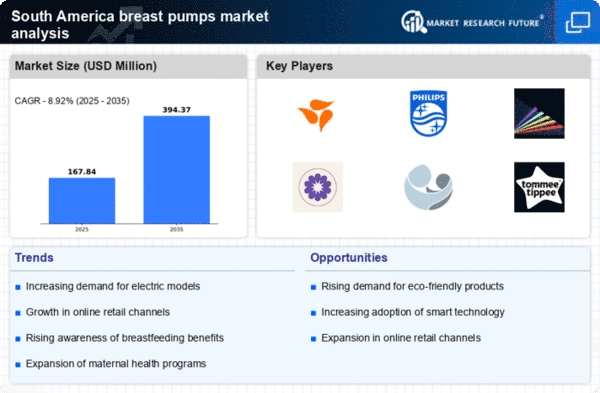

Technological innovations in breast pump design are significantly influencing the breast pumps market. Manufacturers are increasingly focusing on developing user-friendly, efficient, and portable breast pumps that cater to the needs of modern mothers. Features such as smartphone connectivity, customizable suction settings, and quieter operation are becoming standard. In South America, the introduction of electric and wearable breast pumps has gained traction, appealing to working mothers who require discreet and efficient solutions. The market is projected to grow as these advancements enhance the overall user experience, making breast pumps more accessible and appealing to a broader audience.

Increasing Awareness of Breastfeeding Benefits

The growing awareness of the health benefits associated with breastfeeding is a crucial driver in the breast pumps market. Educational campaigns by health organizations and government bodies in South America emphasize the advantages of breastfeeding for both infants and mothers. This heightened awareness has led to an increase in breastfeeding rates, which in turn drives demand for breast pumps. According to recent data, approximately 70% of mothers in South America initiate breastfeeding, and many seek breast pumps to facilitate this process. The breast pumps market is likely to see continued growth as more mothers recognize the importance of breastfeeding and the convenience that breast pumps provide.

Leave a Comment